CV Writing for Accountants

Your CV is your professional introduction, a succinct summary of your skills, experiences, and the unique value you bring as an accountant. It's about striking a balance between showcasing your technical accounting skills and your strategic impact on business growth. Writing an effective CV means emphasizing the aspects of your career that highlight your analytical expertise and demonstrate why you're the perfect fit for accounting roles.

Whether you're targeting a role in tax accounting, financial analysis, or corporate finance, these guidelines will help ensure your CV stands out to employers.

Highlight Your Certification and Specialization: Clearly state qualifications like CPA, CMA, or ACCA. Detail specializations such as tax, forensic, or management accounting early on in your CV.

Quantify Your Impact: Share achievements with numbers, like a 15% cost reduction from auditing or a 20% revenue increase from financial management.

Align Your CV to the Job Description: Match your CV content to the job's requirements, highlighting relevant experiences like risk management if emphasized by the employer.

Detail Your Tech Proficiency: List proficiency in software like QuickBooks, Sage, or Oracle Financials, and any experience with data analysis tools or ERP systems. These are important.

Showcase Soft Skills and Leadership: Briefly mention leadership, teamwork, or your knack for explaining complex financial data in simple terms.

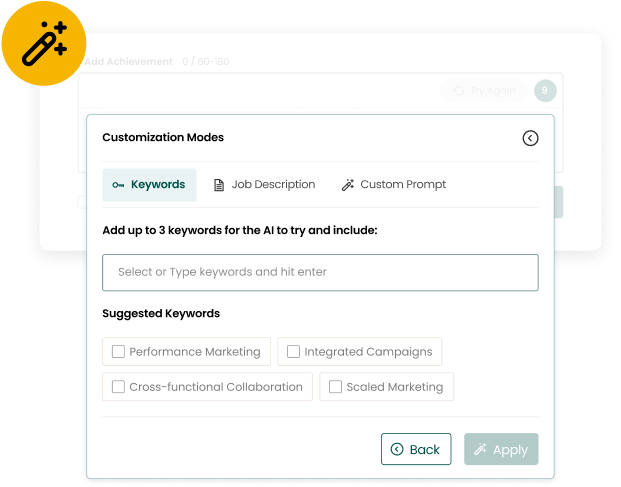

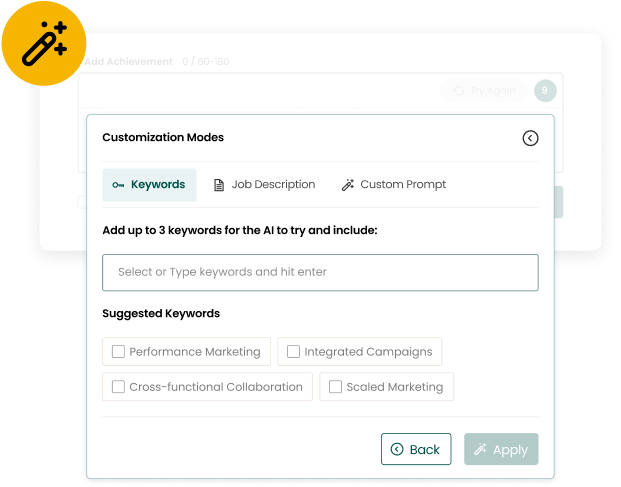

The Smarter, Faster Way to Write Your CV

Craft your summaries and achievements more strategically in less than half the time.

Revamp your entire CV in under 5 minutes.

Write Your CV with AI

Emily Rivera

Florida

•

(180) 839-1904

•

•

linkedin.com/in/emily-rivera

Dynamic Accountant with a proven track record of implementing financial strategies that enhance revenue predictions by 30% and reduce data processing time by 35%. Expert in leading high-performance teams, achieving a 20% productivity increase, and playing a key role in strategic planning, contributing to a 10% profit increase. With a knack for financial risk management and a 100% compliance rate in tax return submissions, I am ready to leverage my skills to ensure financial stability and growth.

Accountant• 01/2024 – Present

Orchestrated the implementation of a new financial forecasting model, leading to a 30% improvement in the accuracy of revenue and expense predictions.

Supervised a team of 7 accountants, fostering a high-performance culture that resulted in a 20% increase in productivity and a 15% decrease in month-end close time.

Revamped the company's financial risk management strategy, mitigating potential losses and safeguarding the company's assets.

Senior Financial Analyst• 03/2023 – 12/2023

Junior Accountant• 11/2021 – 03/2023

SKILLS

Financial Forecasting

Team Leadership and Supervision

Financial Risk Management

Accounting Software Proficiency

Financial Auditing

Strategic Financial Planning

Tax Preparation and Compliance

Budgeting and Expense Reduction

Cross-Functional Collaboration

Data-Driven Decision Making

EDUCATION

Bachelor of Science in Accounting

University of Richmond

Richmond, VA

2016-2020

CERTIFICATIONS

Certified Financial Services Auditor (CFSA)

04/2024

The Institute of Internal Auditors (IIA)

Certified Fraud Examiner (CFE)

04/2023

Association of Certified Fraud Examiners (ACFE)

Certified Internal Auditor (CIA)

04/2022

The Institute of Internal Auditors (IIA)

Liam Hawthorne

Florida

•

(763) 482-3910

•

•

linkedin.com/in/liam-hawthorne

Dedicated Staff Accountant with a proven track record of streamlining financial processes, enhancing accuracy, and driving cost savings. Expert in implementing innovative budget forecasting models, managing regulatory compliance, and coordinating audits, resulting in a 15% reduction in audit findings. With a knack for identifying discrepancies and improving efficiency, I am committed to contributing my skills to enhance financial integrity and support strategic decision-making.

Staff Accountant• 01/2024 – Present

Streamlined the accounts payable process, reducing invoice processing time by 30% and improving vendor relationships through timely payments.

Implemented a new budget forecasting model, improving the accuracy of financial projections by 20% and supporting strategic decision-making.

Managed the preparation of monthly, quarterly, and annual financial statements, ensuring 100% compliance with regulatory standards and deadlines.

Senior Financial Analyst• 03/2023 – 12/2023

Radiant Financial Advisors

Junior Accountant• 11/2021 – 03/2023

SKILLS

Accounts Payable Management

Budget Forecasting

Financial Reporting

Audit Coordination

Internal Controls Development

Budget Preparation

Account Reconciliation

Accounting Software Implementation

Tax Preparation and Filing

Operational Cost Reduction

EDUCATION

Bachelor of Science in Accounting

University of Dayton

Dayton, OH

2016-2020

CERTIFICATIONS

Certified Internal Auditor (CIA)

04/2024

Institute of Internal Auditors (IIA)

Certified Financial Services Auditor (CFSA)

04/2023

Institute of Internal Auditors (IIA)

Certified Fraud Examiner (CFE)

04/2022

Association of Certified Fraud Examiners (ACFE)

Liam Hawthorne

Florida

•

(736) 482-1957

•

•

linkedin.com/in/liam-hawthorne

Highly skilled Senior Accountant with a proven track record in implementing financial systems and strategies that enhance accuracy, efficiency, and profitability. With experience in leading high-performing teams, I have successfully reduced operational costs by 15% and improved revenue projections by 30%. My expertise in ensuring regulatory compliance, streamlining reporting processes, and aligning financial planning with strategic goals positions me to significantly contribute to the financial success of my next organization.

Senior Accountant• 01/2024 – Present

Orchestrated the implementation of a new financial forecasting model, improving the accuracy of revenue projections by 30% and enabling more informed strategic decision-making.

Supervised a team of 7 accountants, fostering a high-performance culture that reduced month-end close times by 20% and improved the accuracy of financial reporting.

Championed a company-wide cost reduction initiative, identifying inefficiencies and implementing changes that resulted in a 15% decrease in operational costs.

Financial Analyst• 03/2023 – 12/2023

Meridian Financial Advisors

Junior Accountant• 11/2021 – 03/2023

Catalyst Investment Group

SKILLS

Financial Forecasting

Team Leadership and Supervision

Cost Reduction and Efficiency Improvement

Tax Preparation and Compliance

Financial Reporting

Financial Analysis

Audit Coordination

Internal Controls Development

Budget Development

Strategic Financial Planning

EDUCATION

Bachelor of Science in Accounting

University of Richmond

Richmond, VA

2014-2018

CERTIFICATIONS

Certified Financial Services Auditor (CFSA)

04/2024

Institute of Internal Auditors (IIA)

Certified Fraud Examiner (CFE)

04/2023

Association of Certified Fraud Examiners (ACFE)

Certified Information Systems Auditor (CISA)

04/2022

Information Systems Audit and Control Association (ISACA)

Landon Hawthorne

Florida

•

(415) 782-3491

•

•

linkedin.com/in/landon-hawthorne

Dedicated Public Accountant with a proven track record in financial risk assessment, team leadership, and process improvement. Successfully managed a diverse client portfolio, reducing tax liabilities and increasing profitability through strategic financial analysis and budgeting. With a knack for implementing innovative systems that enhance data accuracy and streamline reporting, I am committed to driving financial excellence and client satisfaction in my next role.

Public Accountant• 01/2024 – Present

DataFusion Analytics Inc.

Orchestrated a comprehensive financial risk assessment for a major client, identifying potential areas of concern and implementing mitigation strategies, resulting in a 30% reduction in financial risk exposure.

Managed a team of 7 junior accountants, providing mentorship and guidance, leading to a 15% increase in team productivity and a 20% decrease in reporting errors.

Implemented a new financial reporting system, streamlining the process and improving the accuracy of financial data, leading to a 35% reduction in time spent on monthly financial reporting.

Senior Auditor• 03/2023 – 12/2023

Junior Accountant• 11/2021 – 03/2023

Zenith Investment Solutions

SKILLS

Financial Risk Assessment

Team Management and Mentorship

Financial Reporting System Implementation

Auditing and Tax Savings Identification

Budgeting Process Development

Collaboration with IT for Financial Software Enhancement

Tax Planning and Compliance Expertise

Detailed Financial Analysis

Cost Reduction and Efficiency Improvement

Financial Reporting System Development

EDUCATION

Bachelor of Science in Accounting

University of Richmond

Richmond, VA

2016-2020

CERTIFICATIONS

Certified Internal Auditor (CIA)

04/2024

The Institute of Internal Auditors (IIA)

Certified Financial Services Auditor (CFSA)

04/2023

The Institute of Internal Auditors (IIA)

Certified Fraud Examiner (CFE)

04/2022

Association of Certified Fraud Examiners (ACFE)

Landon Hawthorne

Florida

•

(736) 482-5910

•

•

linkedin.com/in/landon-hawthorne

Dedicated Property Accountant with a proven track record in optimizing financial processes and reporting for a portfolio of 50+ properties, resulting in a 20% increase in client satisfaction. Expert in implementing innovative accounting systems, reducing data processing time by 30%, and managing tax compliance to decrease liabilities by 15%. With a history of uncovering significant discrepancies, saving clients an average of $30,000, I am eager to leverage my expertise to drive financial efficiency and accuracy in my next role.

Property Accountant• 01/2024 – Present

Implemented a new property management accounting system, resulting in a 30% reduction in data processing time and enhancing the accuracy of financial reports.

Managed a portfolio of 50+ properties, ensuring accurate and timely financial reporting, leading to a 20% increase in client satisfaction.

Streamlined the property tax compliance process, reducing tax liabilities by 15% through meticulous planning and application of tax credits.

Senior Property Accountant• 03/2023 – 12/2023

Junior Property Accountant• 11/2021 – 03/2023

SolidRock Capital Advisors

SKILLS

Property Management Accounting

Financial Reporting & Analysis

Property Tax Compliance

Team Leadership & Management

Financial Auditing

Internal Audit Program Development

Strategic Cost Reduction & Efficiency Improvement

Error Reduction in Financial Reporting

IT Collaboration & Custom Financial Dashboard Development

Strategic Decision-Making Support

EDUCATION

Bachelor of Science in Accounting

University of Wisconsin-La Crosse

La Crosse, WI

2016-2020

CERTIFICATIONS

Certified Property Manager (CPM)

04/2024

Institute of Real Estate Management (IREM)

Certified Commercial Investment Member (CCIM)

04/2023

CCIM Institute

Certified Public Accountant (CPA)

04/2022

American Institute of Certified Public Accountants (AICPA)

Liam Hargrove

Florida

•

(547) 392-8164

•

•

linkedin.com/in/liam-hargrove

Dedicated Payroll Accountant with extensive experience in streamlining payroll processes, reducing discrepancies, and ensuring tax compliance for large workforces. Proven success in implementing new payroll systems, leading to significant increases in efficiency and accuracy. With a track record of reducing payroll errors, improving employee satisfaction, and providing expert guidance on payroll tax laws, I am ready to bring my skills to a new challenge.

Payroll Accountant• 01/2024 – Present

Streamlined the payroll process for a workforce of over 500 employees, reducing processing time by 30% and significantly improving payroll accuracy.

Implemented a new payroll software system, resulting in a 20% reduction in payroll discrepancies and a 15% increase in processing efficiency.

Managed and reconciled all payroll-related liabilities, ensuring 100% compliance with federal, state, and local tax laws and preventing potential penalties.

Payroll Specialist• 03/2023 – 12/2023

Beacon Investment Solutions

Payroll Clerk• 11/2021 – 03/2023

SKILLS

Payroll Processing Efficiency

Payroll Software Implementation

Compliance with Tax Laws

Interdepartmental Coordination

Payroll Audit System Development

Expertise in Payroll Tax Laws and Regulations

Timely and Accurate Payroll Processing

Payroll System Transition

Payroll Discrepancy Identification and Rectification

Improvement of Employee Satisfaction

EDUCATION

Bachelor of Science in Accounting

University of North Dakota

Grand Forks, ND

2016-2020

CERTIFICATIONS

Certified Payroll Professional (CPP)

04/2024

American Payroll Association (APA)

Fundamental Payroll Certification (FPC)

04/2023

American Payroll Association (APA)

Certified Public Accountant (CPA)

04/2022

American Institute of Certified Public Accountants (AICPA)

Cassandra Belford

Florida

•

(415) 782-9036

•

•

linkedin.com/in/cassandra-belford

Dedicated Junior Accountant with a proven track record in improving financial processes, reducing reporting errors by 15%, and enhancing data processing efficiency by 30%. I've contributed to a 10% decrease in tax liabilities through effective compliance strategies and played a key role in saving an average of $20,000 per client through meticulous financial audits. Eager to leverage my skills in financial analysis, budget planning, and audit procedures to drive financial excellence in my next role.

Junior Accountant• 01/2024 – Present

DataFusion Analytics Inc.

Assisted in the preparation of monthly financial reports, contributing to a 15% reduction in reporting errors and enhancing the accuracy of financial data.

Participated in the implementation of a new accounting software, leading to a 30% improvement in the efficiency of financial data processing.

Supported the senior accountant in managing tax compliance procedures, resulting in a 10% decrease in tax liabilities through careful planning and application of tax credits.

Accounting Assistant• 03/2023 – 12/2023

Audit Intern• 11/2021 – 03/2023

Apex Investment Solutions

SKILLS

Financial Reporting

Accounting Software Proficiency

Tax Compliance Management

Budget Planning

Internal Audit Procedures

Reconciliation Processes

Financial Auditing

Stakeholder Communication

International Tax Compliance

Cost Reduction Strategies

EDUCATION

Bachelor of Science in Accounting

University of Dayton

Dayton, OH

2019-2023

CERTIFICATIONS

Certified Internal Auditor (CIA)

04/2024

Institute of Internal Auditors (IIA)

Certified Financial Services Auditor (CFSA)

04/2023

Institute of Internal Auditors (IIA)

Certified Fraud Examiner (CFE)

04/2022

Association of Certified Fraud Examiners (ACFE)

Liam Hargrove

Florida

•

(734) 582-4916

•

•

linkedin.com/in/liam-hargrove

Dedicated General Ledger Accountant with a proven track record of streamlining reconciliation processes, enhancing financial reporting accuracy, and driving revenue growth. Expert in implementing innovative accounting systems, reducing operational expenses, and ensuring compliance with GAAP. With a history of facilitating smooth audits and providing critical financial insights, I am poised to leverage my expertise to contribute to strategic financial management and business growth.

General Ledger Accountant• 01/2024 – Present

DataFusion Analytics Inc.

Streamlined the general ledger reconciliation process, reducing the monthly close cycle by 30% and significantly improving the accuracy of financial reports.

Implemented a new accounting software system, enhancing the efficiency of journal entry postings and reducing data entry errors by 20%.

Managed the preparation and analysis of monthly, quarterly, and annual financial statements, providing key insights that informed strategic decision-making and contributed to a 15% increase in annual revenue.

Senior Financial Analyst• 03/2023 – 12/2023

Quantum Capital Strategies

Junior Accountant• 11/2021 – 03/2023

SKILLS

General Ledger Reconciliation

Accounting Software Implementation

Financial Statement Preparation and Analysis

Budgeting and Cost Reduction

GAAP Compliance

Audit Coordination

Account Analysis and Reconciliation

Transition to Automated Accounting Systems

Financial Reporting and Presentation

Strategic Financial Planning

EDUCATION

Bachelor of Science in Accounting

University of Richmond

Richmond, VA

2016-2020

CERTIFICATIONS

Certified Public Accountant (CPA)

04/2024

American Institute of Certified Public Accountants (AICPA)

Certified Financial Services Auditor (CFSA)

04/2023

Institute of Internal Auditors (IIA)

Certified Information Systems Auditor (CISA)

04/2022

Information Systems Audit and Control Association (ISACA)

Landon Beckett

Florida

•

(764) 392-5810

•

•

linkedin.com/in/landon-beckett

Dedicated Fund Accountant with a proven track record of managing over $500 million in assets, driving a 30% reduction in fund accounting processing time, and increasing report accuracy by 15%. Expert in implementing reconciliation systems, enhancing financial reporting, and launching new funds, resulting in significant savings and improved compliance. Eager to leverage my expertise in fund accounting, auditing, and team leadership to contribute to the financial success of my next organization.

Fund Accountant• 01/2024 – Present

Quantum Analytics Solutions

Streamlined the fund accounting process, resulting in a 30% reduction in processing time and a 15% increase in accuracy of financial reports.

Managed a portfolio of over $500 million in assets, ensuring accurate and timely valuation, pricing, and compliance with regulatory standards.

Implemented a new reconciliation system that improved the detection of discrepancies by 20%, safeguarding the fund against potential financial risks.

Senior Fund Accountant• 03/2023 – 12/2023

Junior Fund Accountant• 11/2021 – 03/2023

SKILLS

Expertise in fund accounting processes

Strong financial reporting and analysis skills

Proficient in GAAP and other regulatory standards

Excellent team management and leadership abilities

Experience in financial auditing and discrepancy detection

Ability to manage large asset portfolios

Proficiency in NAV calculations and fund transaction reconciliation

Experience in coordinating and launching new funds

Strong collaboration skills, particularly with IT departments

Ability to implement efficient work processes and provide continuous training

EDUCATION

Bachelor of Science in Accounting

University of Richmond

Richmond, VA

2016-2020

CERTIFICATIONS

Certified Public Accountant (CPA)

04/2024

American Institute of Certified Public Accountants (AICPA)

Chartered Financial Analyst (CFA)

04/2023

CFA Institute

Certified Fund Raising Executive (CFRE)

04/2022

CFRE International

Entry Level Accountant CV Example

Create Your CV

Liam Hawthorne

Florida

•

(547) 892-3610

•

•

linkedin.com/in/liam-hawthorne

Dedicated Entry Level Accountant with a strong track record in improving financial reporting accuracy, streamlining accounting processes, and ensuring tax compliance. I've contributed to a 5% reduction in operational expenses through strategic budgeting and enhanced vendor relationships by reducing invoice processing time by 30%. Eager to apply my meticulous attention to detail and proficiency in accounting software to drive efficiency and accuracy in my next role.

Entry Level Accountant• 01/2024 – Present

Assisted in the preparation of monthly financial statements, improving the accuracy of reported data by 15% through meticulous attention to detail and data verification.

Contributed to a team project that streamlined the accounts payable process, reducing invoice processing time by 30% and improving vendor relationships.

Participated in the annual budgeting process, aiding in the identification of cost-saving opportunities that resulted in a 5% reduction in operational expenses.

Accounting Intern• 03/2023 – 12/2023

Junior Accountant• 11/2021 – 03/2023

Catalyst Wealth Management

SKILLS

Financial Statement Preparation

Accounts Payable Management

Budgeting and Cost Reduction

Tax Preparation and Compliance

Auditing and Financial Reporting

Accounting Software Proficiency

Bank Reconciliation

Timely Financial Reporting

Accounts Receivable Management

Customer Relationship Management

EDUCATION

Bachelor of Science in Accounting

University of North Dakota

Grand Forks, ND

2020-2024

CERTIFICATIONS

Certified Internal Auditor (CIA)

04/2024

The Institute of Internal Auditors (IIA)

Certified Financial Services Auditor (CFSA)

04/2023

The Institute of Internal Auditors (IIA)

Certified Fraud Examiner (CFE)

04/2022

Association of Certified Fraud Examiners (ACFE)

Landon Caldwell

Florida

•

(736) 482-1957

•

•

linkedin.com/in/landon-caldwell

Dedicated Cost Accountant with a proven track record of implementing cost-efficient strategies, leading to significant reductions in production costs and overhead expenses. Expert in conducting detailed cost audits and variance analyses, resulting in substantial savings and improved accuracy of cost data. With a knack for leading teams to enhance cost allocation processes and a demonstrated ability to design innovative cost control systems, I am poised to contribute to the financial success of my next organization.

Cost Accountant• 01/2024 – Present

Orchestrated the implementation of a new cost accounting system, resulting in a 30% reduction in time spent on cost analysis and a 20% increase in accuracy of cost data.

Managed a team of 4 cost accountants, achieving a 15% decrease in overhead costs through the identification and elimination of inefficiencies in the cost allocation process.

Developed and executed a comprehensive cost reduction strategy, leading to a 10% decrease in production costs without compromising product quality.

Cost Analyst• 03/2023 – 12/2023

Junior Cost Accountant• 11/2021 – 03/2023

SKILLS

Cost Accounting System Implementation

Team Management and Leadership

Cost Reduction Strategy Development

Cost Variance Analysis

Collaboration with Production Department

Budgeting and Financial Planning

Cost Auditing

Cost Allocation Method Development

Cost Control System Design and Implementation

Efficiency Improvement and Overhead Cost Reduction

EDUCATION

Bachelor of Science in Accounting

University of Wisconsin-La Crosse

La Crosse, WI

2016-2020

CERTIFICATIONS

Certified Cost Professional (CCP)

04/2024

Association for the Advancement of Cost Engineering (AACE)

Certified in Strategy and Competitive Analysis (CSCA)

04/2023

Institute of Management Accountants (IMA)

Certified in Production and Inventory Management (CPIM)

04/2022

Association for Supply Chain Management (ASCM)

Liam Hawthorne

Florida

•

(678) 392-4561

•

•

linkedin.com/in/liam-hawthorne

Dynamic Chartered Accountant with a proven track record of enhancing financial systems, reducing discrepancies by 20%, and increasing investment returns by 15% for high net worth clients. Expert in implementing risk management frameworks, saving companies significant potential losses, and leading successful acquisitions through meticulous financial analysis. With a history of boosting team productivity by 25% and reducing operational expenses by 10%, I am committed to driving financial efficiency and accuracy in my next role.

Chartered Accountant• 01/2024 – Present

Orchestrated a complete revamp of the company's financial management system, resulting in a 30% increase in efficiency and a 20% reduction in financial discrepancies.

Successfully managed a portfolio of high net worth clients, providing strategic financial advice that led to an average of 15% increase in their investment returns.

Implemented a robust financial risk management framework, mitigating potential financial risks and saving the company an estimated $200,000 in potential losses.

Senior Financial Auditor• 03/2023 – 12/2023

Junior Accountant• 11/2021 – 03/2023

SKILLS

Financial Management System Revamp

Portfolio Management

Financial Risk Management

Financial Auditing

Strategic Tax Planning

Due Diligence and Financial Analysis

Team Leadership and Mentorship

Budgeting and Cost Reduction

Cross-functional Collaboration

Custom Financial Reporting System Development

EDUCATION

Bachelor of Science in Accounting

University of Hartford

West Hartford, CT

2016-2020

CERTIFICATIONS

Certified Financial Services Auditor (CFSA)

04/2024

The Institute of Internal Auditors (IIA)

Certified Fraud Examiner (CFE)

04/2023

Association of Certified Fraud Examiners (ACFE)

Certified Information Systems Auditor (CISA)

04/2022

Information Systems Audit and Control Association (ISACA)

Lorenzo Caldwell

Florida

•

(847) 562-3190

•

•

linkedin.com/in/lorenzo-caldwell

Dedicated Accountant Assistant with a proven track record in enhancing financial processes and reporting, contributing to a 10% increase in yearly revenue and a 15% reduction in reporting errors. Experienced in implementing new accounting software, improving efficiency by 30%, and assisting in tax compliance, resulting in a 10% decrease in tax liabilities. With a strong ability to identify cost reduction opportunities and safeguard against financial penalties, I am eager to apply my skills to contribute to the financial success of my next team.

Accountant Assistant• 01/2024 – Present

Assisted in the preparation of monthly financial reports, contributing to a 15% reduction in reporting errors and enhancing the accuracy of financial data.

Supported the implementation of a new accounting software, leading to a 30% improvement in the efficiency of financial data processing and reporting.

Collaborated with the senior accountant in managing tax compliance procedures, resulting in a 10% decrease in tax liabilities through careful planning and application of tax credits.

Junior Accountant• 03/2023 – 12/2023

Financial Analyst• 11/2021 – 03/2023

SKILLS

Financial Reporting

Accounting Software Proficiency

Tax Compliance Management

Budgeting and Cost Reduction

Internal Auditing

Financial Reconciliation

Financial Analysis

Audit Preparation

Collaboration with IT for Financial Solutions

Strategic Financial Planning

EDUCATION

Bachelor of Science in Accounting

University of Wisconsin-La Crosse

La Crosse, WI

2016-2020

CERTIFICATIONS

Certified Bookkeeper (CB)

04/2024

American Institute of Professional Bookkeepers (AIPB)

Certified Payroll Professional (CPP)

04/2023

American Payroll Association (APA)

Certified Fraud Examiner (CFE)

04/2022

Association of Certified Fraud Examiners (ACFE)

Enhance your writing process and tailor every CV to the job description.

Build your CV

CV Structure & Format for Accountants

Crafting a CV for an accountant role requires careful attention to structure and format. A well-organized CV not only highlights your most relevant skills and achievements, but also reflects your professional attributes and attention to detail, which are crucial in the accounting field.

Essential CV Sections for Accountants

Every accountant's CV should include the following core sections to provide a comprehensive overview of their professional journey:

1. Personal Statement: This should be a concise summary of your qualifications, accounting expertise, and career aspirations.

2. Work Experience: Detail your professional history in accounting, emphasizing your responsibilities and achievements in each role.

3. Education: List your academic qualifications, focusing on accounting-related degrees and other relevant education.

4. Certifications: Highlight any accounting certifications such as CPA, CMA, or ACCA that you hold.

5. Skills: Showcase your specific accounting skills, including proficiency in accounting software like QuickBooks or Sage.

Optional Sections

Consider adding these optional sections to further tailor your CV and distinguish yourself:

1. Professional Affiliations: Membership in professional accounting bodies like the AICPA or IMA can demonstrate your commitment to the field.

2. Projects: Highlight significant accounting projects or audits you've led or contributed to.

3. Awards and Honors: Any recognition received for your work in accounting can demonstrate your dedication and excellence.

4. Continuing Education: List any additional courses or seminars you've attended to stay updated with the latest accounting standards and technology.

Getting Your CV Structure Right

An effectively structured CV can reflect the order and precision that are inherent in the accounting profession. Here are some tips to refine your CV’s structure:

Logical Flow: Start with a compelling personal statement, followed by your work experience, ensuring a logical progression through your CV.

Highlight Key Achievements Early: Place significant accomplishments prominently within each section, especially in your work experience.

Use Reverse Chronological Order: List your roles starting with the most recent to immediately show employers your current level of responsibility and expertise.

Keep It Professional and Precise: Opt for a straightforward, professional layout and use concise language that reflects the precision required in accounting.

Personal Statements for Accountants

The personal statement in an Accountant's CV is a critical component that can set the tone for the rest of the document. It provides a platform to highlight your unique skills, professional aspirations, and the value you can bring to potential employers. It's your opportunity to stand out from the crowd and make a lasting impression. Let's explore some examples of strong and weak personal statements to help you craft your own.

Accountant Personal Statement Examples

Strong Statement

"As a dedicated and certified Accountant with over 7 years of experience in financial analysis, budgeting, and tax preparation, I have consistently delivered accurate and timely financial reports. My passion for financial management and my ability to identify cost-saving opportunities have significantly contributed to the profitability of my previous employers. I am eager to leverage my skills and experience to drive financial success in a challenging new role."

Weak Statement

"I am an Accountant with some experience in budgeting and tax preparation. I enjoy working with numbers and am looking for a job where I can use my skills. I have some knowledge of financial reports and have assisted with tax preparation in the past."

Strong Statement

"Highly skilled and results-driven Accountant with a solid background in financial management, tax compliance, and strategic planning. As a CPA with over 10 years of experience in both public and private sectors, I have a proven track record of improving financial processes, reducing tax liabilities, and providing valuable financial insights. I am excited to bring my expertise and commitment to a dynamic and innovative company."

Weak Statement

"I have experience in accounting, including preparing financial documents and filing taxes. I am familiar with financial planning and compliance. I am seeking a position where I can apply my knowledge and skills in accounting."

How to Write a Statement that Stands Out

To craft a standout personal statement, focus on your unique skills and achievements, particularly those that have had a measurable impact on your previous employers. Ensure your statement aligns with the job description, demonstrating how your expertise can address the specific needs of the potential employer.CV Career History / Work Experience

The "Career Experience" section of your Accountant CV is a powerful tool to showcase your professional journey and accomplishments. It's an opportunity to translate your skills, expertise, and achievements into a compelling narrative that grabs the attention of potential employers. By providing detailed, quantifiable examples of your past responsibilities and successes, you can significantly enhance your appeal to prospective employers. Here are some examples to guide you in crafting impactful and less effective experience descriptions.

Accountant Career Experience Examples

Strong

"As a dedicated and certified Accountant with over 7 years of experience in financial analysis, budgeting, and tax preparation, I have consistently delivered accurate and timely financial reports. My passion for financial management and my ability to identify cost-saving opportunities have significantly contributed to the profitability of my previous employers. I am eager to leverage my skills and experience to drive financial success in a challenging new role."

Weak

"I am an Accountant with some experience in budgeting and tax preparation. I enjoy working with numbers and am looking for a job where I can use my skills. I have some knowledge of financial reports and have assisted with tax preparation in the past."

Strong

"Highly skilled and results-driven Accountant with a solid background in financial management, tax compliance, and strategic planning. As a CPA with over 10 years of experience in both public and private sectors, I have a proven track record of improving financial processes, reducing tax liabilities, and providing valuable financial insights. I am excited to bring my expertise and commitment to a dynamic and innovative company."

Weak

"I have experience in accounting, including preparing financial documents and filing taxes. I am familiar with financial planning and compliance. I am seeking a position where I can apply my knowledge and skills in accounting."

How to Make Your Career Experience Stand Out

To make your career experience stand out, focus on providing specific, quantifiable examples of your achievements. Highlight your expertise in areas such as financial reporting, budgeting, and tax strategy. Showcase projects where you've made a significant impact, such as implementing new software or strategies that resulted in cost savings or increased efficiency. Tailor your experience to the accountant role, demonstrating how your unique skills and experiences can contribute to the success of the organization.CV Skills & Proficiencies for Accountant CVs

The "Career Experience" section of your Accountant CV is a powerful tool to showcase your professional journey and accomplishments. It's an opportunity to translate your skills, expertise, and achievements into a compelling narrative that grabs the attention of potential employers. By providing detailed, quantifiable examples of your past responsibilities and successes, you can significantly enhance your appeal to prospective employers. Here are some examples to guide you in crafting impactful and less effective experience descriptions.

CV Skill Examples for Accountants

Technical Expertise:

Financial Analysis & Reporting: Ability to interpret financial data and prepare reports that contribute to strategic decision-making.

Taxation Compliance & Strategy: Proficiency in applying current tax laws to ensure compliance and optimize tax strategies.

Accounting Software Mastery: Skilled in using accounting software (e.g., QuickBooks, Xero, SAP) to streamline financial processes.

Auditing Procedures: In-depth knowledge of auditing standards and practices to conduct thorough financial audits.Interpersonal & Collaboration Skills

Interpersonal Strengths and Soft Skills:

Effective Communication: Convey complex financial information in understandable terms to non-finance stakeholders.

Leadership & Team Coordination: Ability to lead project teams and coordinate efforts to meet financial reporting deadlines.

Problem-Solving: Innovative approach to resolving financial discrepancies and streamlining accounting workflows.

Adaptability: Flexibility in adapting to new financial regulations, technologies, and organizational changes.

Cultivating a Compelling Skills Section on Your CV

Focus on aligning your technical and interpersonal skills with the requirements of the role you're targeting. Quantify your achievements where possible, and illustrate your skills with concrete examples from your career. Tailoring your CV to reflect the specific needs of potential employers can significantly enhance your candidacy.How to Tailor Your Accountant CV to a Specific Job

Tailoring your CV to the target job opportunity should be your single most important focus when creating a CV.

Tailoring your CV for each Accountant role is not just beneficial—it's essential. By customizing your CV, you can highlight your most relevant skills and experiences, aligning them directly with the employer's needs. This will significantly enhance your candidacy and set you apart as the ideal fit for the role.

Focus on Relevant Experiences

Identify and prioritize experiences that directly align with the job’s requirements. For example, if the role requires expertise in financial auditing, emphasize your successes in this area. This will demonstrate your suitability and readiness for similar challenges in the new role.

Use Industry-Related Keywords

Mirror the language used in the job posting in your CV. This will help your CV pass through Applicant Tracking Systems (ATS) and signal to hiring managers that you are a perfect fit for their specific needs. Including key terms like “financial analysis” or “budget management” can directly link your experience with the job’s demands.

Showcase Your Technical Skills and Certifications

Highlight the technical skills or certifications that are particularly valued in the Accountant field. For instance, if you are proficient in accounting software like QuickBooks or have a Certified Public Accountant (CPA) certification, make sure these are prominently displayed on your CV.

Highlight Your Soft Skills and Collaborative Experiences

Don't forget to showcase your soft skills or experiences in collaborative environments. Skills like communication, problem-solving, and teamwork are often highly valued in the Accountant role. Align these skills with the job specifications to demonstrate your ability to thrive in the role.

Align Your Professional Summary with the Job Requirements

Ensure your professional summary or personal statement aligns with the key qualifications and attributes sought in the Accountant position. A concise mention of your relevant experiences, skills, and career goals can make a powerful first impression, immediately showcasing your alignment with the role.CV FAQs for Accountants

How long should Accountants make a CV?

The optimal length for an accountant's CV is 1-2 pages, providing ample space to detail your qualifications and expertise without overwhelming with excessive information. Focus on clarity and relevance by highlighting your most significant accounting achievements—those that best demonstrate your proficiency and success in roles akin to the ones you're targeting.

What's the best format for an Accountant CV?

The most effective format for an Accountant CV is the reverse-chronological layout. This format prioritizes your recent and relevant accounting experiences, showcasing your career growth and achievements. It allows potential employers to quickly assess your accounting skills and progression. Ensure each section highlights your accounting-specific skills, qualifications, and accomplishments, aligning them with the job requirements.

How does a Accountant CV differ from a resume?

To differentiate your Accountant CV, emphasize your unique achievements using quantifiable data. Highlight any specialized certifications, software proficiency, or professional development courses. Tailor your CV to each job, mirroring the language in the job description. Include specific examples of how you've added value, such as cost reductions or revenue growth. This approach will make your CV resonate more effectively with hiring managers, setting you apart from other candidates.