Why Every Accounts Receivable Manager Should Have Goals

In the meticulous and dynamic realm of financial management, the role of an Accounts Receivable Manager is pivotal to the fiscal health of an organization. Establishing precise and quantifiable goals is not merely advantageous; it is a fundamental necessity. These goals serve as a navigational beacon, steering every ledger entry, policy implementation, and stakeholder interaction. They carve out a definitive vision of triumph, ensuring that each action taken is a deliberate stride towards the summit of professional achievement. For Accounts Receivable Managers, well-defined goals are the bedrock of career progression, fostering innovation, strategic foresight, and the empowerment of teams to collectively surmount the challenges of the financial sector.

Goals are the lifeblood of direction and clarity, transforming daily tasks into steps on a ladder leading to long-term career aspirations. They are the catalysts that propel an Accounts Receivable Manager to transcend traditional practices, sparking creativity and pioneering solutions that safeguard the company's cash flow and revenue streams. In the crucible of strategic planning, goals are the crucible that tempers decision-making, ensuring that every plan is aligned with the company's financial targets and operational benchmarks.

Moreover, the significance of goal congruence cannot be overstated. When an Accounts Receivable Manager's personal ambitions resonate with the team's objectives and the broader organizational vision, a powerful synergy is unleashed. This alignment galvanizes teams, fortifying their resolve to achieve collective milestones and driving the organization towards fiscal excellence.

This introduction is designed to be both motivational and pragmatic, offering Accounts Receivable Managers tangible insights into the transformative power of goal-setting. It is an invitation to embrace the discipline of defining clear goals, recognizing their profound impact on one's career trajectory, and the success of the financial teams they lead.

Different Types of Career Goals for Accounts Receivable Managers

In the dynamic role of an Accounts Receivable Manager, setting career goals is essential for navigating the complexities of financial management and customer relations. By identifying a variety of goal types, professionals can construct a comprehensive career development plan that balances the immediacy of cash flow management with the broader vision of financial leadership. Understanding these diverse goals enables Accounts Receivable Managers to cultivate a career path that is both rewarding and progressive, ensuring that each achievement builds towards a future of professional excellence.

Financial Accuracy and Efficiency Goals

Goals centered on financial accuracy and efficiency are paramount for Accounts Receivable Managers. This may involve reducing the days sales outstanding (DSO) metric, improving the accuracy of invoice generation, or streamlining payment processes through automation. These goals not only enhance the financial health of the organization but also demonstrate your capability to manage receivables with precision and agility.

Customer Relationship and Retention Goals

As an Accounts Receivable Manager, fostering positive customer relationships is crucial. Goals in this category might include developing strategies to handle late payments diplomatically, enhancing customer communication protocols, or implementing customer satisfaction surveys to identify areas for improvement. These goals help maintain a healthy cash flow while ensuring customer loyalty and reducing turnover, which is vital for long-term business success.

Regulatory Compliance and Risk Management Goals

Navigating the complex landscape of financial regulations requires Accounts Receivable Managers to set goals around compliance and risk management. This could involve staying abreast of changes in financial regulations, implementing robust internal controls to prevent errors and fraud, or developing a comprehensive risk assessment framework. Achieving these goals ensures that the organization's receivables are managed within legal boundaries and that financial risks are minimized.

Professional Development and Team Leadership Goals

For those looking to advance their careers, setting goals related to professional development and team leadership is essential. This might include pursuing advanced certifications in finance or credit management, attending industry conferences, or leading cross-functional projects to improve interdepartmental collaboration. These goals not only enhance your own skill set but also position you as a leader who can drive team performance and contribute to organizational success.

Strategic Planning and Innovation Goals

Accounts Receivable Managers must also set goals that focus on strategic planning and innovation. This could involve developing new billing models that align with evolving market demands, leveraging data analytics to forecast financial trends, or initiating projects that improve the overall financial strategy of the organization. By setting and achieving these goals, you demonstrate your ability to contribute to the company's long-term financial planning and innovation initiatives.

By setting goals across these diverse categories, Accounts Receivable Managers can ensure a well-rounded approach to their career development, balancing the need for immediate results with the pursuit of long-term growth and leadership in the field.

What Makes a Good Career Goal for a Accounts Receivable Manager?

In the meticulous and fast-paced world of finance, Accounts Receivable Managers stand as pivotal figures, ensuring the health and efficiency of a company's cash flow. Setting well-defined career goals is not just about climbing the corporate ladder; it's about becoming a beacon of innovation, leadership, and strategic acumen in the field of accounts receivable management. These goals are the compass that guides professionals to not only excel in their current roles but also to shape the future of financial operations within their organizations.

Career Goal Criteria for Accounts Receivable Managers

Mastery of Financial Principles and Practices

A robust career goal for an Accounts Receivable Manager should include the pursuit of comprehensive knowledge in financial principles and practices. This means staying abreast of the latest accounting standards, technological advancements in billing and collections, and understanding regulatory compliance. Mastery in these areas ensures that you can lead your team effectively and contribute to the financial stability of your organization.

Acquire Advanced Accounting Certifications

Implement Cutting-Edge AR Technologies

Stay Current with Financial Regulations

Technological Proficiency and Innovation

In an era where technology is reshaping financial processes, a good career goal must encompass the adoption and implementation of cutting-edge financial software and tools. As an Accounts Receivable Manager, aiming to become a champion of technological innovation not only streamlines operations but also positions you as a forward-thinking leader who drives efficiency and accuracy in financial reporting.

Master AR-specific software

Lead digital payment integrations

Advocate for data analytics use

Leadership and Team Development

Leadership is a cornerstone of the Accounts Receivable Manager's role. Setting a goal to develop and refine your leadership skills is crucial. This includes fostering a collaborative team environment, mentoring staff, and enhancing communication channels. By doing so, you can build a resilient team capable of tackling challenges and contributing to the company's financial success.

Implement Effective AR Training

Enhance Team Performance Metrics

Strengthen Interdepartmental Collaboration

Strategic Debt Management

A well-crafted career goal for an Accounts Receivable Manager should focus on strategic debt management. This involves setting targets for reducing days sales outstanding (DSO) and improving the percentage of current receivables. By honing strategies for effective credit and collections management, you can directly impact your company's liquidity and working capital, making this an essential goal for career advancement.

Optimize Credit Risk Assessments

Implement Proactive Collection Tactics

Enhance Receivables Turnover Ratio

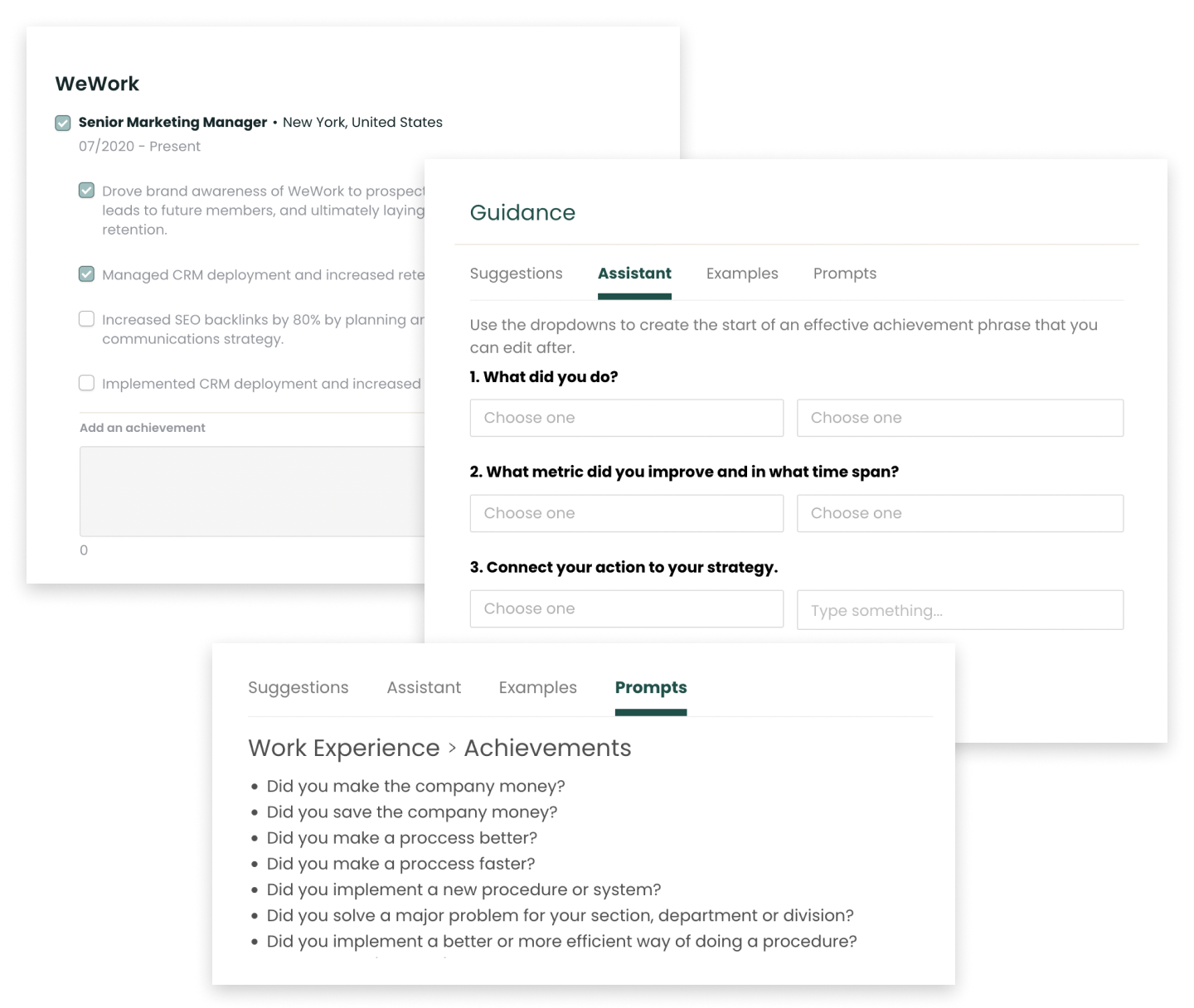

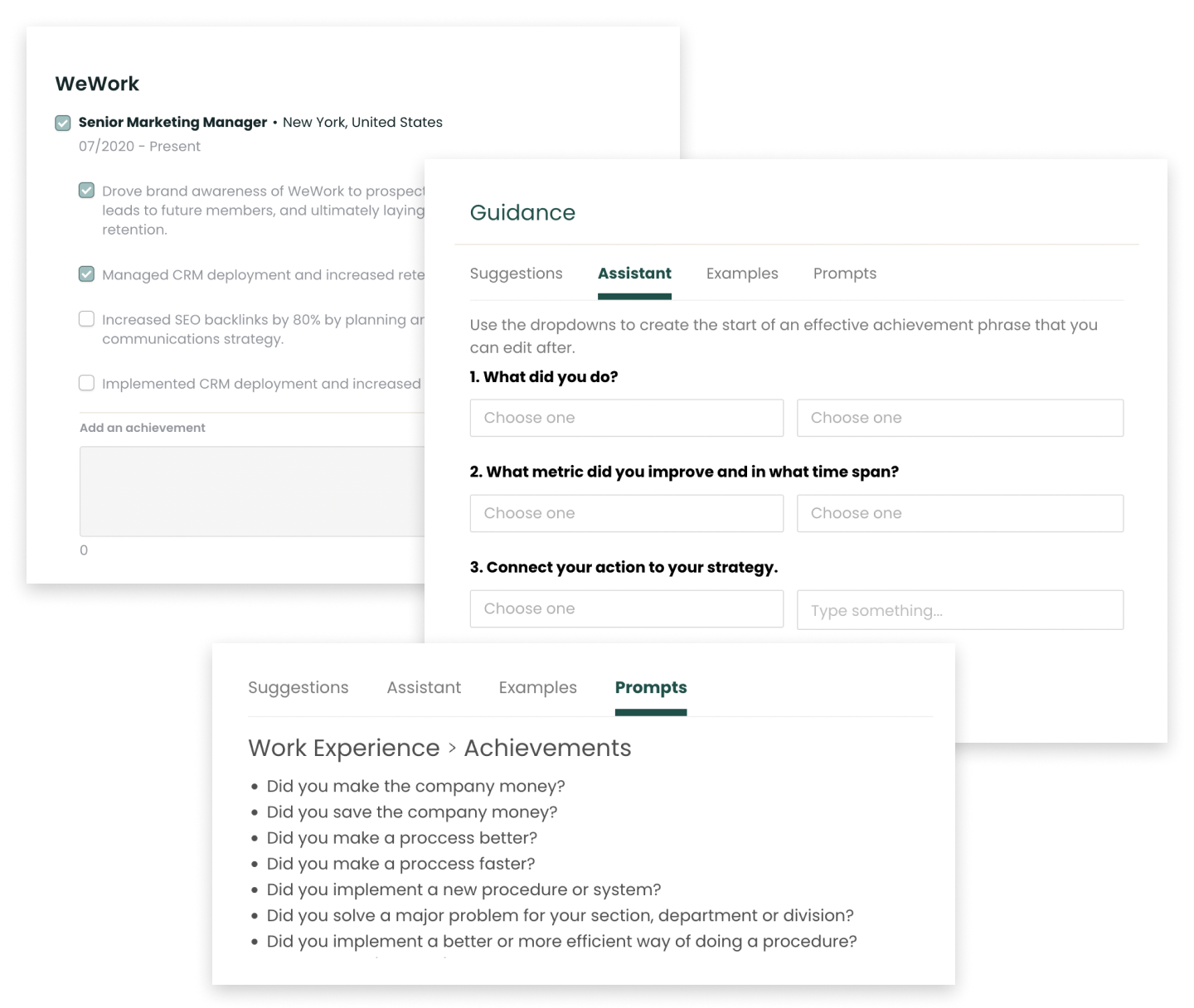

Log Your Wins Every Week with Teal

Document your career wins and achievements every week while they are fresh, then add them when you need.

Track Your Achievements for Free

12 Professional Goal Examples for Accounts Receivable Managers

Setting professional goals as an Accounts Receivable Manager is essential for guiding your career path, enhancing your department's efficiency, and achieving financial success for your organization. By establishing clear and strategic objectives, you can focus on areas that will have the most significant impact on your professional development and the company's bottom line. The following goal examples are designed to inspire Accounts Receivable Managers to set ambitious yet attainable career milestones that foster personal growth and contribute to the overall success of their teams.

Optimize the Accounts Receivable Process

Streamlining the accounts receivable process is a fundamental goal for any AR Manager. Focus on reducing the days sales outstanding (DSO) by implementing efficient billing practices, improving invoice accuracy, and leveraging automation tools. An optimized AR process leads to better cash flow management and enhances customer satisfaction.

Enhance Team Productivity through Training

Commit to developing a highly skilled AR team by providing regular training and professional development opportunities. By ensuring that your team is proficient in the latest accounting software, compliance regulations, and effective collection strategies, you can improve productivity and reduce errors in the accounts receivable process.

Implement a Robust Credit Management System

Develop and maintain a comprehensive credit management system to assess customer creditworthiness accurately. This goal involves setting clear credit policies, performing regular credit reviews, and managing risk effectively. A robust credit management system can minimize bad debt and improve the financial health of the company.

Achieve Industry-Specific Certification

Pursue a certification in an area relevant to accounts receivable, such as Certified Accounts Receivable Professional (CARP) or Certified Credit and Collections Manager (CCCM). This goal demonstrates your commitment to the field and can provide you with advanced knowledge and skills that enhance your leadership and strategic decision-making abilities.

Foster Strong Customer Relationships

Set a goal to build and maintain positive relationships with customers. This involves proactive communication, negotiating payment plans where necessary, and providing excellent customer service. Strong relationships can lead to more timely payments and can turn the accounts receivable department into a customer service asset.

Master Data Analysis for AR Insights

Develop expertise in data analysis to gain insights into accounts receivable trends and performance metrics. By setting a goal to master analytics tools and techniques, you can identify patterns, predict customer payment behaviors, and make informed decisions to improve cash flow and reduce delinquencies.

Lead a Digital Transformation Initiative

Embrace the challenge of leading a digital transformation within the accounts receivable department. This goal involves evaluating and implementing new technologies such as AI, machine learning, and blockchain to automate processes, reduce manual labor, and increase accuracy and efficiency.

Cultivate a Culture of Continuous Improvement

Strive to create a culture that continuously seeks to improve processes, policies, and performance. Encourage your team to identify inefficiencies, suggest solutions, and implement changes that can lead to a more effective accounts receivable operation.

Expand Your Understanding of Global AR Practices

For those working in multinational companies, aim to understand and navigate the complexities of global accounts receivable management. This includes learning about different tax regulations, currency exchange risks, and cultural considerations in billing and collections.

Drive Policy and Procedure Documentation

Ensure that all accounts receivable policies and procedures are thoroughly documented and regularly updated. This goal is vital for maintaining consistency, training new staff, and providing a clear framework for the AR team to follow, which is especially important in times of regulatory changes or audits.

Enhance Interdepartmental Collaboration

Work towards breaking down silos and enhancing collaboration between the accounts receivable department and other departments such as sales, customer service, and finance. Effective collaboration can lead to a more cohesive understanding of customer accounts and can streamline the resolution of disputes and discrepancies.

Advocate for Ethical Collection Practices

Commit to upholding and advocating for ethical collection practices within your organization. This goal not only ensures compliance with laws and regulations but also maintains the integrity of the company and fosters trust with customers.

Find Accounts Receivable Manager Openings

Explore the newest Accounts Receivable Manager roles across industries, career levels, salary ranges, and more.

Career Goals for Accounts Receivable Managers at Difference Levels

Setting career goals as an Accounts Receivable Manager is essential for professional growth and success in the field of finance. As you progress through different stages of your career, your objectives should evolve to meet the increasing complexity and responsibility of your role. Aligning your goals with your current expertise and the trajectory you envision for your career will help you navigate the challenges and leverage the opportunities that come with each level of advancement.

Setting Career Goals as an Entry-Level Accounts Receivable Manager

At the entry-level, your primary aim should be to establish a strong understanding of accounts receivable processes and best practices. Goals for this stage might include mastering the use of AR software, understanding the nuances of credit management, and developing effective communication skills to handle customer inquiries and disputes. These foundational goals are critical for building the skills necessary to manage receivables efficiently and serve as a springboard for future career development.

Setting Career Goals as a Mid-Level Accounts Receivable Manager

As a mid-level Accounts Receivable Manager, you should focus on enhancing your leadership abilities and strategic thinking. Set goals to improve team productivity, such as implementing new technologies or processes that streamline collections. You might also aim to reduce days sales outstanding (DSO) significantly or improve the accuracy of cash flow forecasting. At this stage, your objectives should balance the improvement of departmental performance with personal growth in management and strategic financial planning.

Setting Career Goals as a Senior-Level Accounts Receivable Manager

At the senior level, your goals should reflect a broader business perspective and a drive for innovation. Consider setting objectives that align AR operations with the overall financial strategy of the company, such as developing policies that optimize working capital or engaging in risk assessment and mitigation. Leadership goals might include mentoring upcoming finance professionals or leading cross-departmental initiatives to improve the company's financial health. As a senior Accounts Receivable Manager, your goals should demonstrate your ability to contribute to the company's success at a strategic level and establish you as a thought leader in the field.

Leverage Feedback to Refine Your Professional Goals

Feedback is an invaluable asset for Accounts Receivable Managers, serving as a compass for navigating the complexities of financial management and customer relations. It provides a foundation for continuous improvement and strategic career development within the field.

Embracing Constructive Criticism for Career Advancement

Constructive criticism is a powerful tool for Accounts Receivable Managers to enhance their strategic approach to managing receivables, improving negotiation skills, and streamlining processes. By embracing feedback from supervisors and peers, you can identify areas for professional growth and adjust your career goals to become more effective in your role.

Integrating Customer Insights into Your Professional Milestones

Customer feedback is critical in shaping how Accounts Receivable Managers handle client relationships and resolve disputes. By understanding the needs and pain points of customers, you can tailor your approach to improve customer satisfaction and retention, which are key metrics for success in this role. Align your career objectives with the goal of enhancing customer experience and financial outcomes.

Utilizing Performance Reviews to Set Targeted Goals

Performance reviews offer a structured evaluation of your achievements and areas for improvement. Use this feedback to set specific, measurable goals that focus on enhancing your competencies, such as communication, accuracy in financial reporting, and leadership. This targeted approach ensures your professional development is in line with both organizational objectives and your personal career aspirations.

Goal FAQs for Accounts Receivable Managers

How frequently should Accounts Receivable Managers revisit and adjust their professional goals?

Accounts Receivable Managers should evaluate their professional goals at least biannually, aligning with fiscal periods to stay in sync with financial cycles and organizational shifts. This semi-annual review ensures strategies remain effective amidst evolving industry regulations, technology advancements, and company objectives, while also fostering continuous personal development and career progression within the financial management landscape.

Can professional goals for Accounts Receivable Managers include soft skill development?

Certainly. For Accounts Receivable Managers, soft skills such as negotiation, communication, and conflict resolution are vital. Aiming to improve these can enhance client relationships, streamline collections, and foster a positive team environment. Setting goals to develop these interpersonal skills is not only appropriate but essential for effectively managing receivables and leading a successful AR team.

How do Accounts Receivable Managers balance long-term career goals with immediate project deadlines?

Accounts Receivable Managers must adeptly navigate the tension between immediate deadlines and long-term ambitions through meticulous organization and prioritization. By establishing clear career milestones, they can identify opportunities within daily operations to enhance their expertise, such as mastering new financial software or improving negotiation skills. This intentional approach ensures that even the most pressing tasks contribute to their overarching professional trajectory, fostering continuous growth alongside operational success.

How can Accounts Receivable Managers ensure their goals align with their company's vision and objectives?

Accounts Receivable Managers must stay attuned to their company's financial health and strategic goals. By actively participating in financial planning and analysis, they can tailor their objectives to enhance cash flow and minimize bad debt, directly supporting the organization's profitability and growth. Regular collaboration with the sales, customer service, and finance departments ensures that their strategies are cohesive and contribute to the company's overarching vision.

Up Next

What is a Accounts Receivable Manager?

Learn what it takes to become a JOB in 2024