Why Every Bank Manager Should Have Goals

In the dynamic realm of banking, where financial landscapes are constantly shifting and customer expectations are ever-evolving, setting precise and measurable goals is not just advantageous; it is imperative. For Bank Managers, goals serve as the navigational stars, steering every policy implementation, risk assessment, and client interaction. They crystallize the definition of success, ensuring that each endeavor is a step towards the pinnacle of one's professional journey.

For those at the helm of banking operations, well-defined goals are the bedrock of career progression, fostering innovation, and strategic foresight. They are the catalysts that propel Bank Managers to pioneer change, optimize financial services, and navigate the complexities of regulatory compliance with confidence. Goals are the blueprints for leadership, empowering managers to inspire their teams, align individual objectives with the bank's mission, and collectively surge towards organizational excellence.

This introduction is designed to ignite a spark in Bank Managers, motivating them to recognize and harness the power of targeted goals. By doing so, they not only amplify their own potential but also elevate the performance and success of their teams and the institution they represent. Embrace the journey of goal-setting, and watch as it transforms the landscape of your career, your team, and the banking industry at large.

Different Types of Career Goals for Bank Managers

In the dynamic role of a Bank Manager, setting a variety of career goals is essential for personal growth and professional excellence. As the banking industry evolves with technological advancements and regulatory changes, Bank Managers must adapt and plan strategically. Understanding the spectrum of career goals can help Bank Managers navigate their career paths effectively, balancing short-term achievements with long-term ambitions, and ensuring that each step taken is deliberate and impactful.

Financial Expertise and Compliance Goals

Financial expertise goals are about deepening your understanding of financial products, services, and regulations. This could mean pursuing advanced certifications in financial analysis, risk management, or compliance. Staying abreast of regulatory changes and ensuring your bank adheres to these regulations is also crucial. These goals ensure that you maintain the integrity and competitiveness of your institution in a tightly regulated industry.

Customer Relationship and Business Development Goals

These goals focus on expanding the bank's customer base and nurturing existing relationships. They might involve implementing innovative customer service strategies, enhancing customer satisfaction scores, or developing new business opportunities. By setting these goals, Bank Managers can drive the bank's profitability and reputation, ensuring a loyal and expanding clientele.

Operational Efficiency and Innovation Goals

Operational goals aim to enhance the bank's internal processes and service delivery. This could include adopting new banking technologies, improving transaction processing times, or reducing operational costs through innovative solutions. These goals are about streamlining operations to increase efficiency, reduce errors, and provide customers with a seamless banking experience.

Leadership and Team Development Goals

Leadership goals are centered on your ability to motivate, develop, and manage your team effectively. This might involve leadership training, mentoring junior staff, or fostering a culture of continuous improvement. By achieving these goals, Bank Managers can build a resilient team capable of meeting the challenges of the banking sector and driving the bank's success.

Strategic Planning and Execution Goals

Strategic planning goals involve setting a clear vision for the bank and outlining the steps to get there. This could mean developing new market penetration strategies, diversifying the bank's portfolio, or leading a digital transformation initiative. These goals require a combination of foresight, analytical thinking, and decisive action, ensuring that the bank remains competitive and adaptable in a changing financial landscape.

By setting and pursuing these diverse career goals, Bank Managers can ensure a well-rounded approach to their professional development, positioning themselves as innovative leaders in the banking industry.

What Makes a Good Career Goal for a Bank Manager?

In the high-stakes world of banking, setting precise career goals is not just a matter of climbing the corporate ladder; it's about becoming a beacon of leadership, innovation, and strategic acumen. For Bank Managers, well-defined career goals are the compass that guides their professional journey, ensuring they not only meet but exceed the expectations of their role, while also fostering personal development and industry-wide impact.

Career Goal Criteria for Bank Managers

Relevance to Banking Trends and Regulations

A Bank Manager's career goal must be deeply rooted in the current trends and regulatory changes within the financial sector. This ensures that their aspirations are not only ambitious but also practical and responsive to the ever-evolving banking landscape. Staying ahead of these changes can position a Bank Manager as a forward-thinking leader, ready to navigate the complexities of the financial world.

Master Regulatory Compliance

Adopt Tech Innovations

Analyze Market Dynamics

Leadership and Team Development

Effective career goals for Bank Managers should include the continuous development of leadership skills and the ability to foster a high-performing team. As the banking industry relies heavily on trust and efficiency, a Bank Manager must aim to cultivate a culture of excellence and integrity within their branch or department, which in turn can lead to improved customer satisfaction and business success.

Enhance Coaching Techniques

Build Team Trust Bonds

Implement Leadership Metrics

Financial Performance and Growth

A hallmark of a good career goal for a Bank Manager is the focus on tangible financial outcomes. Goals should be tied to the growth of the bank's portfolio, profitability, and market share. By setting clear financial targets, Bank Managers can measure their success and make data-driven decisions that propel both their career and the bank's objectives forward.

Set Quantifiable Profit Targets

Expand Customer Base Metrics

Enhance Asset Portfolio Quality

Customer Relationship and Satisfaction

In the banking industry, customer trust and satisfaction are paramount. A Bank Manager's career goals should prioritize the development of long-term customer relationships and the enhancement of customer service. This focus not only contributes to customer retention but also attracts new business, driving the bank's reputation and success.

Implement Customer Feedback Loops

Enhance Personalized Banking Experiences

Boost Client Financial Education

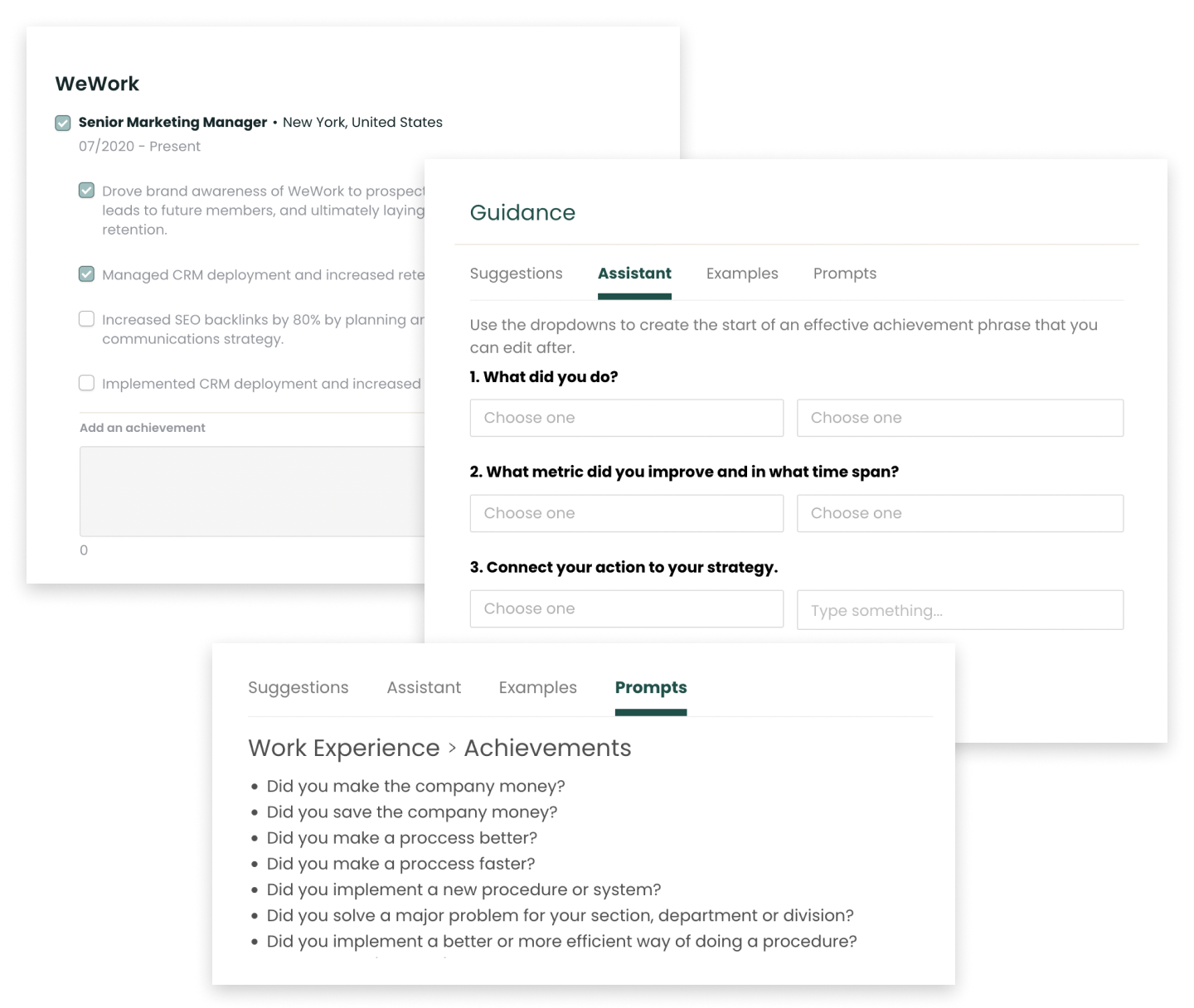

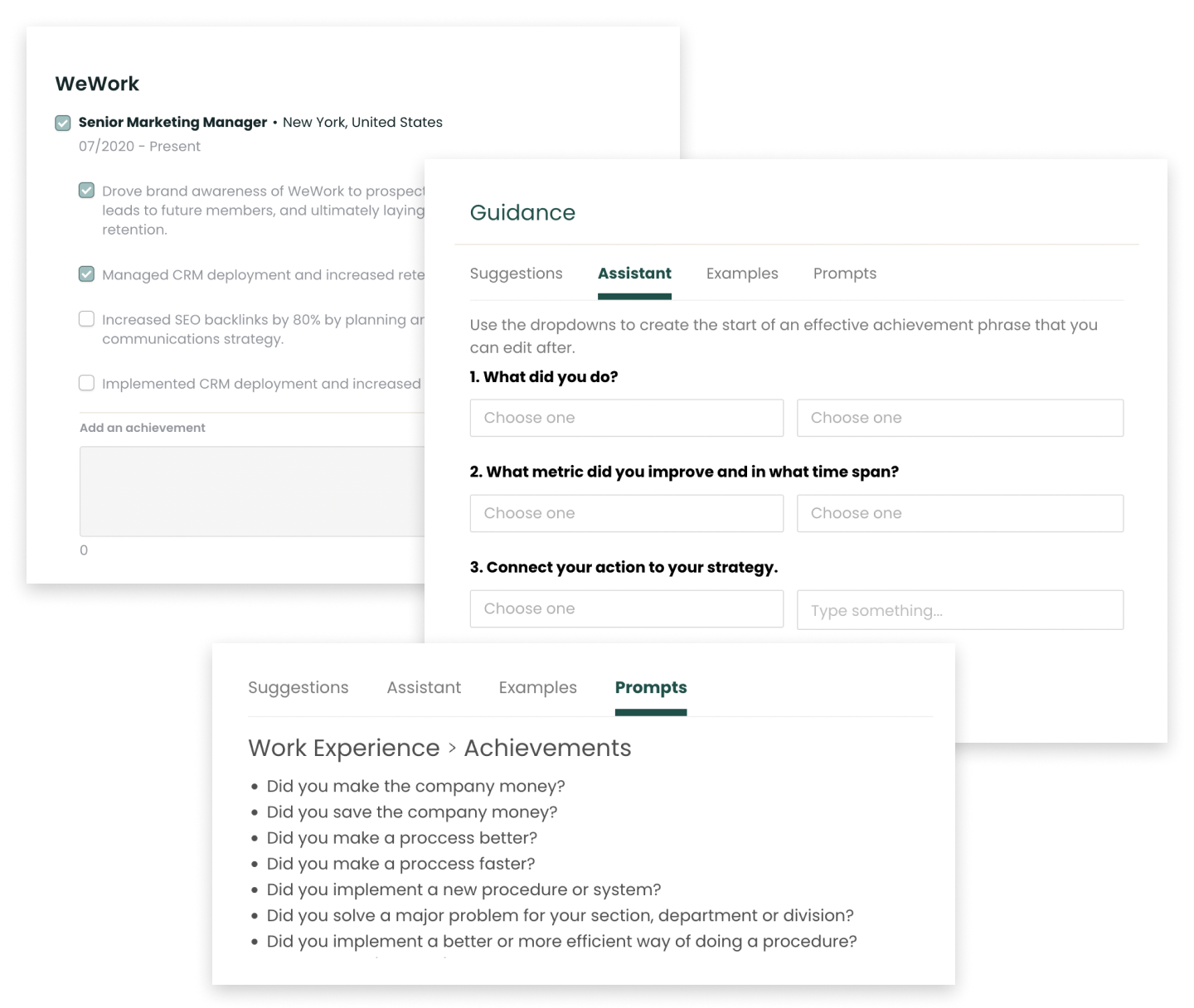

Log Your Wins Every Week with Teal

Document your career wins and achievements every week while they are fresh, then add them when you need.

Track Your Achievements for Free

12 Professional Goal Examples for Bank Managers

Setting professional goals is essential for Bank Managers who aim to excel in their roles and navigate the complexities of the financial industry. These goals serve as benchmarks for success, enabling managers to focus their efforts on key areas that will enhance their capabilities, improve their bank's performance, and advance their careers. Below are targeted professional goals designed to inspire Bank Managers to achieve excellence and lead their institutions to new heights.

Enhance Financial Product Knowledge

As a Bank Manager, deepening your understanding of financial products is paramount. Commit to becoming an expert in new and existing offerings, such as loans, investments, and insurance. This knowledge not only helps in advising clients but also in training staff, ultimately leading to more informed decision-making and improved customer satisfaction.

Strengthen Risk Management Strategies

Develop and refine risk management protocols to protect the bank's assets and reputation. This goal involves staying current with compliance regulations, understanding market trends, and implementing robust risk assessment tools. By prioritizing risk management, you ensure the bank's stability and longevity in a volatile financial landscape.

Drive Branch Performance Metrics

Set a goal to improve key performance indicators such as customer satisfaction, loan volume, and cost efficiency. Use data analytics to identify areas for improvement, set realistic targets, and develop strategies to meet and exceed these benchmarks. Success in this area reflects your ability to manage operations effectively and achieve business growth.

Cultivate a Customer-Centric Culture

Emphasize the importance of a customer-first approach within your branch. Aim to lead by example and inspire your team to deliver exceptional service. This goal involves regular training, feedback sessions, and implementing policies that prioritize customer needs, fostering loyalty and attracting new business.

Expand Leadership and Coaching Skills

Aspire to enhance your leadership qualities by providing mentorship and coaching to your team. This goal could involve creating development programs, offering one-on-one coaching sessions, and encouraging a culture of continuous learning. By investing in your team's growth, you contribute to a more dynamic and capable workforce.

Optimize Operational Efficiency

Target the streamlining of bank operations to reduce costs and improve service delivery. This may include adopting new technologies, revising workflows, and eliminating redundancies. Achieving operational efficiency can lead to better resource allocation and a more agile response to market changes.

Pursue Advanced Banking Certifications

Seek out advanced certifications in areas such as financial planning, investment management, or compliance. These credentials not only enhance your expertise but also demonstrate your dedication to professional growth and adherence to industry best practices.

Foster Team Collaboration and Morale

Set the goal to build a collaborative work environment that encourages open communication and teamwork. Implement regular team-building activities, recognize outstanding contributions, and create a supportive atmosphere. A cohesive team is more effective and can provide better service to clients.

Develop a Robust Business Continuity Plan

Ensure your branch is prepared for unforeseen events by developing and maintaining a comprehensive business continuity plan. This involves assessing potential risks, creating response strategies, and conducting regular drills. Being prepared minimizes the impact of disruptions and maintains trust with clients.

Enhance Digital Banking Services

With the rise of fintech, aim to lead the integration of innovative digital banking solutions. This goal requires staying informed about technological advancements, understanding customer preferences for digital services, and overseeing the implementation of user-friendly online and mobile banking platforms.

Build Community Engagement and Partnerships

Strive to strengthen the bank's presence in the community by initiating partnerships and participating in local events. This engagement not only enhances the bank's reputation but also opens opportunities for new business and reinforces the bank's commitment to social responsibility.

Master Regulatory Compliance and Governance

Commit to mastering the intricacies of banking regulations and governance. This goal is crucial for ensuring that the bank operates within legal frameworks and maintains high ethical standards, thereby protecting the institution from legal risks and enhancing its reputation for integrity.

Find Bank Manager Openings

Explore the newest Bank Manager roles across industries, career levels, salary ranges, and more.

Career Goals for Bank Managers at Difference Levels

Setting career goals is a pivotal aspect of professional development, particularly for Bank Managers who are tasked with the critical responsibility of steering their branches towards success. As one progresses through the ranks, from entry-level to senior management, the nature of these goals shifts, reflecting the evolving challenges and opportunities inherent to each stage. It is essential for Bank Managers to set goals that not only align with their current competencies and roles but also propel them towards their long-term aspirations, ensuring a trajectory of continuous growth and achievement in the banking industry.

Setting Career Goals as an Entry-Level Bank Manager

At the entry-level, Bank Managers should focus on cultivating a robust understanding of bank operations, regulations, and customer service excellence. Goals might include mastering compliance standards, developing effective risk management strategies, or enhancing client satisfaction through personalized service. These objectives serve as the bedrock for a successful banking career, equipping new managers with the essential skills and knowledge needed to navigate the complexities of the financial world.

Setting Career Goals as a Mid-Level Bank Manager

Mid-level Bank Managers are expected to take on greater responsibilities and drive branch performance. Goals at this stage should emphasize leadership development, operational efficiency, and financial acumen. Consider aiming to improve branch profitability, implement innovative banking solutions, or lead successful cross-selling initiatives. These goals not only contribute to the bank's success but also prepare managers for advanced leadership roles by honing their strategic thinking and management skills.

Setting Career Goals as a Senior-Level Bank Manager

Senior-level Bank Managers are strategists and influencers within the banking sector. Their goals should reflect a commitment to shaping the future of banking through visionary leadership and strategic partnerships. Objectives may include driving digital transformation initiatives, expanding the bank's market share, or mentoring the next generation of banking leaders. At this echelon, a Bank Manager's goals should encapsulate their expertise, their ability to enact significant change, and their role as a key player in the financial industry's evolution.

Leverage Feedback to Refine Your Professional Goals

Feedback is an indispensable asset in the career of a Bank Manager, serving as a compass for navigating the complexities of the financial industry. It provides invaluable insights from various sources, enabling Bank Managers to hone their skills, adapt to changing market dynamics, and achieve professional excellence.

Utilizing Constructive Criticism to Sharpen Leadership Skills

Constructive criticism is a powerful catalyst for growth. For Bank Managers, it can pinpoint areas of improvement in management style, risk assessment, and decision-making processes. Embrace this feedback to refine your leadership approach, ensuring your professional objectives are in sync with the evolving landscape of the banking sector.

Integrating Customer Insights into Strategic Planning

Customer feedback is a treasure trove of information that can guide a Bank Manager in shaping services and operations. Use these insights to align your career goals with the pursuit of customer satisfaction and loyalty, thereby driving the bank's success and your professional advancement in a customer-centric industry.

Leveraging Performance Reviews for Goal Realignment

Performance reviews offer a structured evaluation of your achievements and areas for improvement. Analyze this feedback to set clear, actionable goals that not only address gaps but also leverage your strengths. This strategic approach to goal setting will keep your career trajectory on a path of continuous growth and alignment with the bank's objectives.

By actively seeking and applying feedback, Bank Managers can ensure their career goals are responsive to the demands of the industry, their personal aspirations, and the expectations of their clientele, thereby fostering a dynamic and successful career in banking.

Goal FAQs for Bank Managers

How frequently should Bank Managers revisit and adjust their professional goals?

Bank Managers should evaluate their professional goals at least semi-annually, aligning with the financial industry's cyclical nature and regulatory changes. This biannual review ensures strategies stay relevant to the evolving banking landscape, customer expectations, and technological advancements. Adjusting goals accordingly helps maintain a competitive edge, fosters continuous improvement, and supports career progression within the dynamic banking sector.

Can professional goals for Bank Managers include soft skill development?

Certainly. For Bank Managers, soft skills such as effective communication, leadership, and relationship-building are fundamental. Aiming to improve these skills can significantly enhance team performance, customer satisfaction, and operational efficiency. Therefore, including soft skill development in professional goals is not only appropriate but essential for the success and growth of a Bank Manager.

How do Bank Managers balance long-term career goals with immediate project deadlines?

Bank Managers must adeptly prioritize and delegate to balance immediate deadlines with long-term goals. They should align short-term projects with their career trajectory, leveraging each task as an opportunity for leadership growth and operational excellence. Effective time management and clear communication of their vision ensure that daily responsibilities serve as stepping stones towards their broader professional objectives.

How can Bank Managers ensure their goals align with their company's vision and objectives?

Bank Managers must stay attuned to their financial institution's strategic priorities through ongoing dialogue with senior executives and stakeholders. By integrating the bank's targets into their branch's objectives, they can create a roadmap that advances both their professional development and the company's mission. This synergy promotes a cohesive banking environment where individual achievements support broader corporate ambitions, enhancing overall performance and customer satisfaction.

Up Next

Learn what it takes to become a JOB in 2024