Why Every Chief Financial Officer Should Have Goals

In the intricate tapestry of corporate finance, the Chief Financial Officer (CFO) stands as the master weaver, aligning threads of strategy, risk management, and fiscal stewardship. For these financial maestros, setting precise, quantifiable goals is not a mere exercise; it is the quintessence of their professional ethos. Goals serve as the CFO's navigational star, illuminating the path through the complexities of economic forecasting, capital structure optimization, and shareholder value creation. They carve out a definitive image of triumph, ensuring that every ledger entry and policy rollout propels the organization towards its financial zenith.

For CFOs, the art of goal-setting transcends the boundaries of personal achievement, fostering a culture of innovation, strategic foresight, and decisive leadership. It is through well-defined objectives that CFOs can spearhead transformative initiatives, driving growth and efficiency in an ever-evolving economic landscape. Goals are the catalysts that prompt CFOs to challenge the status quo, to reimagine financial processes, and to harness new technologies that can redefine industry standards.

Moreover, the alignment of personal goals with the collective aims of the finance team and the broader organizational vision is paramount. Such synergy ensures that every fiscal maneuver is a step in the right direction, fortifying the company's financial health and competitive edge. In this way, goal-setting is not just a personal roadmap for the CFO but a strategic blueprint for the entire enterprise.

This introduction is designed to ignite a spark within CFO professionals, to embolden them to set and pursue goals with vigor and vision. It is a call to recognize the transformative power of objectives that are as ambitious as they are attainable, and to embrace the profound impact that goal-oriented leadership can have on their career trajectory and the success of the organizations they steward.

Different Types of Career Goals for Chief Financial Officers

In the dynamic role of a Chief Financial Officer (CFO), setting a variety of career goals is essential for steering both the financial health of an organization and personal professional growth. As a CFO, your objectives should encompass a broad spectrum of competencies, from technical financial acumen to strategic leadership. Understanding and pursuing a range of career goals can help you build a comprehensive skill set that not only meets the immediate needs of your company but also positions you for long-term success in the ever-evolving financial landscape.

Financial Expertise and Strategy Goals

Financial expertise and strategy goals are at the core of a CFO's professional development. These goals might include mastering the latest financial software, staying abreast of regulatory changes, or developing innovative financial strategies that drive profitability and growth. By continuously enhancing your financial knowledge and strategic thinking, you ensure that you can lead your organization through complex financial landscapes and contribute to its long-term success.

Leadership and Executive Presence Goals

Leadership and executive presence goals are pivotal for a CFO who must not only manage finances but also lead teams and influence decision-making at the highest levels. This could involve improving your negotiation skills, becoming a more effective communicator, or learning how to better manage cross-functional teams. As you ascend the corporate ladder, your ability to lead with confidence and authority becomes as important as your financial acumen.

Operational Efficiency and Innovation Goals

Operational efficiency and innovation goals focus on your capacity to optimize financial operations and champion initiatives that enhance productivity and cost-effectiveness. This might mean implementing new financial systems, automating processes, or introducing data analytics to inform decision-making. Embracing innovation in financial operations not only drives your organization forward but also showcases your ability to lead transformative change.

Networking and Relationship Building Goals

Networking and relationship building goals are crucial for CFOs who must often navigate complex stakeholder landscapes. These goals could involve expanding your professional network, building stronger relationships with investors, or collaborating more effectively with other C-suite executives. By cultivating a robust network and fostering strategic partnerships, you can enhance your influence and open up new opportunities for both your company and your career.

Personal Branding and Thought Leadership Goals

Personal branding and thought leadership goals help establish you as a respected voice in the financial community. This might include speaking at industry events, publishing insightful articles, or serving on advisory boards. By building your personal brand, you not only contribute to the discourse shaping the financial industry but also create a legacy that transcends your current role.

By setting and pursuing these diverse career goals, CFOs can ensure they remain at the forefront of their field, ready to tackle the challenges of today's business world and pave the way for future success.

What Makes a Good Career Goal for a Chief Financial Officer?

In the high-stakes financial landscape, Chief Financial Officers (CFOs) stand at the helm, steering their organizations through economic currents with acumen and foresight. Well-defined career goals are not just a ladder to higher echelons of professional success; they are the crucible within which CFOs forge their legacy as strategic thinkers, leaders, and innovators. These goals are the compass by which CFOs navigate the complex interplay of finance, strategy, and leadership.

Career Goal Criteria for Chief Financial Officers

Strategic Integration

A CFO's career goal must be intricately woven into the strategic fabric of their organization. It should reflect an understanding of how financial decisions impact and are impacted by broader business objectives. This integration ensures that CFOs are not just financial stewards, but also key players in shaping the company's future.

Align Goals with Corporate Vision

Forecast Long-Term Financial Health

Balance Risk with Growth Opportunities

Leadership Development

CFOs must continuously cultivate their leadership skills. Goals should therefore include aspects of mentorship, team building, and cross-departmental collaboration. As the financial world evolves, so too should the CFO's ability to lead diverse teams and drive organizational change.

Enhance Strategic Decision-Making

Strengthen Financial Acumen

Drive Fiscal Responsibility

Technological Proficiency

In an era where data reigns supreme, CFOs must aim to stay ahead of the technological curve. Goals related to mastering new financial technologies, data analytics, and cybersecurity will keep a CFO relevant and proactive in mitigating risks and capitalizing on data-driven opportunities.

Implement Advanced Data Analytics

Adopt Cutting-Edge FinTech

Enhance Cybersecurity Measures

Financial Acumen and Innovation

A CFO's goals should reflect a commitment to deepening financial expertise while also pushing the envelope of traditional financial management. This might include developing innovative funding strategies, exploring sustainable growth models, or implementing cutting-edge financial reporting techniques.

Master Advanced Analytics

Explore Diverse Capital Sources

Implement Risk Management Models

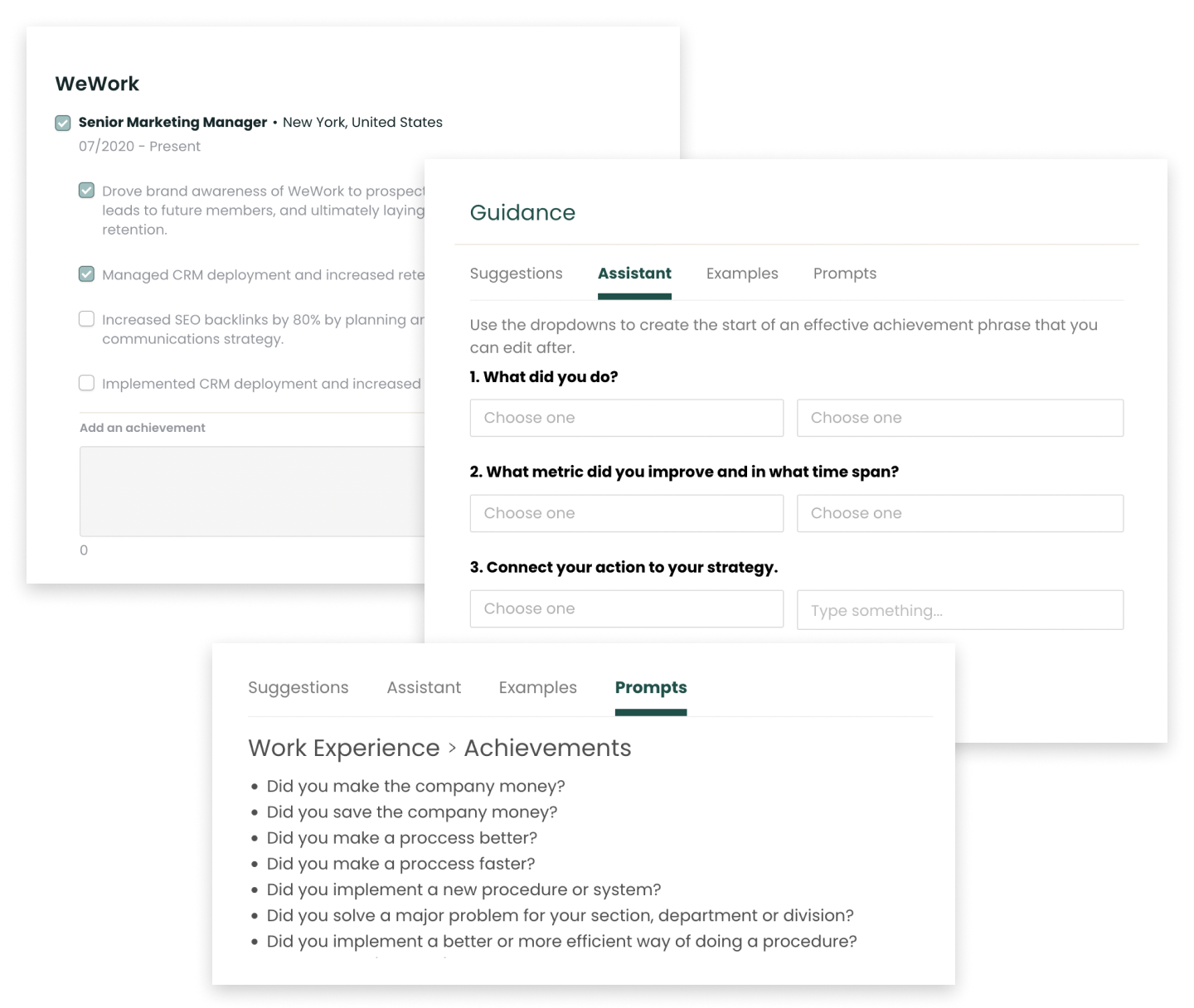

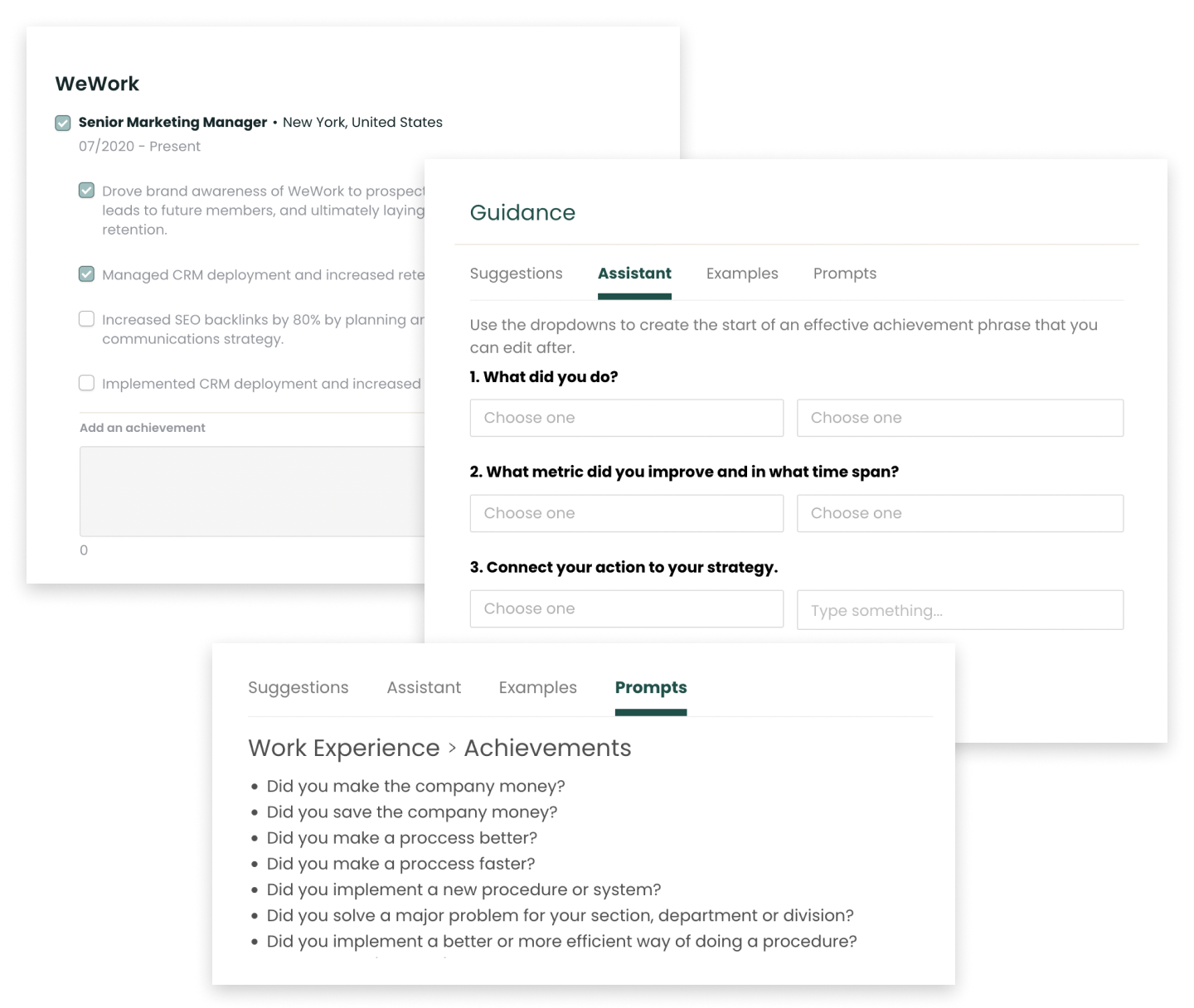

Log Your Wins Every Week with Teal

Document your career wins and achievements every week while they are fresh, then add them when you need.

Track Your Achievements for Free

12 Professional Goal Examples for Chief Financial Officers

Setting professional goals as a Chief Financial Officer (CFO) is a strategic endeavor that requires foresight, ambition, and a clear understanding of the financial landscape. These goals not only help CFOs navigate the complexities of financial management but also ensure they are leading their organizations toward fiscal stability and growth. The following examples of professional goals are designed to inspire CFOs to set ambitious yet achievable targets that will enhance their leadership capabilities, optimize financial operations, and contribute to their company's success.

Enhance Financial Forecasting Accuracy

Improving the precision of financial forecasts is paramount for a CFO. Commit to leveraging new technologies and data analytics to refine forecasting models, allowing for better strategic decisions and resource allocation. This goal supports proactive management of financial risks and opportunities.

Strengthen Compliance and Control Systems

As regulatory environments evolve, aim to fortify your organization's compliance framework. This involves staying updated with changes in financial regulations, implementing robust internal controls, and ensuring transparency in financial reporting, which are critical for maintaining investor trust and avoiding legal pitfalls.

Lead a Digital Transformation in Finance

Embark on a digital transformation journey within the finance department. This goal entails adopting cutting-edge financial software, automating processes, and enhancing data security. A digital-first approach can streamline operations, reduce errors, and provide real-time financial insights.

Optimize Capital Structure

Strategically manage your company's capital structure to balance debt and equity, minimizing the cost of capital while maximizing shareholder value. This goal requires a deep understanding of market conditions and the ability to negotiate favorable terms with financial institutions.

Develop a Robust Risk Management Framework

Construct a comprehensive risk management plan that identifies, assesses, and mitigates financial risks. This goal is about being prepared for market volatility, credit risks, and liquidity challenges, ensuring the organization's financial health is safeguarded.

Cultivate Financial Leadership Talent

Focus on mentoring and developing the next generation of financial leaders within your organization. This goal involves identifying high-potential talent, providing training and development opportunities, and creating a succession plan to ensure continuity in financial leadership.

Drive Cost Reduction and Efficiency

Set a goal to systematically review and optimize the company's cost structure. This may involve renegotiating supplier contracts, streamlining operations, or implementing lean finance principles to enhance efficiency and boost the bottom line.

Expand Investor Relations Efforts

Enhance your investor relations strategy to communicate more effectively with shareholders and the investment community. This goal includes providing clear financial narratives, responding to investor inquiries with transparency, and actively participating in investor conferences.

Foster Ethical Financial Practices

Commit to upholding and promoting the highest standards of ethics in all financial dealings. This goal is about leading by example, creating an ethical culture within the finance team, and ensuring all financial practices align with the company's values and social responsibilities.

Pursue Continuing Education

Stay at the forefront of financial management by pursuing advanced degrees, certifications, or executive education programs. This goal is about continuous learning and staying updated with the latest financial theories, practices, and regulatory changes.

Lead Strategic Mergers and Acquisitions

Play a pivotal role in identifying and executing strategic mergers and acquisitions that align with the company's growth objectives. This goal involves due diligence, financial modeling, negotiation, and integration planning to ensure successful M&A activities.

Implement Sustainable Financial Strategies

Integrate sustainability into the company's financial strategies by focusing on long-term value creation, social impact investments, and environmental, social, and governance (ESG) criteria. This goal reflects a commitment to responsible stewardship and aligns with the broader global sustainability agenda.

Find Chief Financial Officer Openings

Explore the newest Chief Financial Officer roles across industries, career levels, salary ranges, and more.

Career Goals for Chief Financial Officers at Difference Levels

Setting career goals is a pivotal aspect of a Chief Financial Officer's professional journey, as these goals provide direction and motivation at every stage. As a CFO, your objectives will naturally evolve as you progress from entry-level to mid-level and ultimately to a senior-level position. It's essential to align these goals with your current expertise, the challenges you face, and your potential for growth within the financial sector.

Setting Career Goals as an Entry-Level Chief Financial Officer

At the entry-level, your primary aim is to establish credibility and a strong understanding of the financial operations within your organization. Goals should include developing a comprehensive grasp of financial reporting standards, building robust analytical skills, and forming effective communication strategies to present financial data to stakeholders. Focus on creating a network of mentors and peers to guide your professional development, and seek opportunities to lead small-scale financial projects to demonstrate your potential.

Setting Career Goals as a Mid-Level Chief Financial Officer

As a mid-level CFO, you're expected to take on greater strategic responsibilities. Your goals should now be centered around enhancing the financial health of the company through innovative strategies and risk management. Consider objectives such as optimizing capital structure, driving cost reduction initiatives, or implementing advanced financial systems and technologies. This is also the time to hone leadership skills, as you'll be expected to mentor junior finance staff and collaborate with other executives to align financial and business strategies.

Setting Career Goals as a Senior-Level Chief Financial Officer

At the senior level, you are a strategic partner in the organization's leadership. Your goals should reflect a broad vision that includes shaping the company's financial future, influencing corporate governance, and playing a pivotal role in major business decisions. Aim to lead transformative initiatives, such as international expansion, mergers and acquisitions, or navigating the company through an IPO. As a senior CFO, your objectives should not only showcase your financial acumen but also your ability to drive the company's growth and adapt to the ever-changing economic landscape.

Leverage Feedback to Refine Your Professional Goals

Feedback is an indispensable asset for Chief Financial Officers (CFOs), serving as a compass for navigating the complexities of financial leadership. It provides invaluable insights that can shape a CFO's decision-making, strategic planning, and career progression, ensuring they remain at the forefront of financial innovation and management excellence.

Utilizing Constructive Criticism to Sharpen Financial Acumen

Constructive criticism is a powerful catalyst for professional growth. CFOs should harness this feedback to refine their strategic financial oversight, enhance risk management skills, and ensure their objectives are in sync with the company's long-term financial health and sustainability.

Incorporating Stakeholder Insights into Strategic Financial Planning

Stakeholder feedback, including insights from board members, investors, and department heads, is critical for CFOs. It helps them align financial strategies with the broader business goals and adapt their career objectives to support organizational growth and stakeholder value creation.

Leveraging Performance Reviews for Professional Development

Performance reviews offer a structured evaluation of a CFO's contributions and areas for improvement. By setting specific, measurable goals based on this feedback, CFOs can focus on enhancing their leadership capabilities, financial expertise, and operational efficiency to ascend to new heights in their careers.

Goal FAQs for Chief Financial Officers

How frequently should Chief Financial Officers revisit and adjust their professional goals?

Chief Financial Officers should evaluate their professional goals at least biannually, aligning with fiscal periods to stay attuned to economic trends, regulatory changes, and corporate performance. This strategic timing enables CFOs to adapt their objectives to financial realities and leadership expectations, ensuring their goals support both immediate fiscal responsibilities and long-term organizational growth.

Can professional goals for Chief Financial Officers include soft skill development?

Certainly. For Chief Financial Officers, soft skills such as strategic communication, leadership, and negotiation are indispensable. Cultivating these abilities can significantly improve cross-departmental collaboration, enhance decision-making processes, and foster a strong organizational culture. Therefore, including soft skill development in a CFO's professional goals is not only appropriate but essential for effective financial leadership and organizational success.

How do Chief Financial Officers balance long-term career goals with immediate project deadlines?

Chief Financial Officers navigate this balance by integrating strategic foresight with financial acumen. They prioritize projects that align with their long-term vision for the company's fiscal health while mastering the art of delegation and resource allocation. By doing so, CFOs ensure that immediate deadlines are met without sacrificing the financial strategies and leadership development essential for their career trajectory and the organization's enduring success.

How can Chief Financial Officers ensure their goals align with their company's vision and objectives?

Chief Financial Officers must engage in continuous dialogue with executive peers and stakeholders to grasp the broader business strategy. By integrating financial planning with organizational ambitions, they can tailor their objectives to propel the company's growth. This synergy not only advances the CFO's professional development but also reinforces their pivotal role in steering the company towards its vision, ensuring financial decisions are deeply rooted in the firm's overarching mission.

Up Next

What is a Chief Financial Officer?

Learn what it takes to become a JOB in 2024