Why Every Entry Level Accountant Should Have Goals

In the meticulous and structured realm of accounting, the establishment of specific, measurable goals is not merely advantageous; it is a cornerstone of professional growth. For Entry Level Accountants, goals serve as a navigational beacon, illuminating the path through the complexities of financial data and regulatory frameworks. They offer a crystalline perspective of what constitutes success, ensuring that each ledger entry and fiscal analysis propels one closer to their career milestones. Within the tapestry of an Entry Level Accountant's role, well-defined objectives are the scaffolding that supports not only personal development but also fosters innovation, strategic foresight, and the cultivation of leadership skills.

These goals are the silent partners in daily tasks and long-term career blueprints, providing direction and clarity that transform routine functions into stepping stones towards loftier professional peaks. By embracing goal-setting, Entry Level Accountants can transcend traditional number-crunching, leveraging their insights to drive strategic decisions and introduce innovative solutions to financial challenges. Moreover, aligning individual aspirations with the collective aims of their teams and the broader vision of their organizations ensures a harmonious pursuit of excellence, where personal achievements resonate with and amplify the success of the whole.

This introduction to the significance of goal-setting for Entry Level Accountants is designed to be both a source of motivation and a practical guide. It underscores the transformative power of well-articulated goals, encouraging these burgeoning professionals to chart a course that not only elevates their capabilities but also contributes to the dynamic evolution of the accounting field.

Different Types of Career Goals for Entry Level Accountants

In the dynamic world of accounting, entry-level accountants have a plethora of career goals to consider that can shape their professional journey. Understanding the spectrum of objectives—from mastering the fundamentals of accounting to positioning oneself for strategic roles—is vital. A well-considered set of goals not only propels you through the early stages of your career but also lays a solid foundation for long-term success. By setting and pursuing a variety of targets, you ensure that your career trajectory is not just about climbing the ladder but also about gaining a breadth of experience and expertise.

Technical Proficiency Goals

Technical proficiency goals are paramount for entry-level accountants as they form the bedrock of your career. This could involve mastering accounting software, understanding complex tax regulations, or becoming proficient in financial analysis and reporting. Achieving these goals equips you with the essential tools to perform your duties with accuracy and efficiency, making you a valuable asset to any accounting team.

Professional Certification Goals

Professional certification goals are a natural progression for those looking to advance in the accounting field. Pursuing certifications such as the CPA (Certified Public Accountant), CMA (Certified Management Accountant), or ACCA (Association of Chartered Certified Accountants) can open doors to higher-level positions and specialized fields. These credentials not only enhance your credibility but also demonstrate your commitment to the profession and your willingness to invest in your career.

Networking and Relationship Building Goals

Networking and relationship-building goals focus on expanding your professional circle and cultivating relationships that can lead to mentorship, collaboration, and new opportunities. For entry-level accountants, this might mean joining professional associations, attending industry events, or simply seeking out advice and guidance from more experienced colleagues. Building a strong network early on can provide support, advice, and access to opportunities that might otherwise be out of reach.

Soft Skills Development Goals

Soft skills development goals are crucial as they complement your technical expertise. Entry-level accountants should aim to enhance their communication, problem-solving, and time management skills. These competencies are essential for interpreting and presenting financial data, collaborating with cross-functional teams, and managing the demands of a fast-paced work environment. Developing these soft skills early on will not only improve your performance but also prepare you for future leadership roles.

Industry Specialization Goals

Industry specialization goals involve gaining expertise in a specific sector, such as healthcare, technology, or finance. Specializing can make you particularly attractive to employers within that niche and can lead to opportunities for in-depth analysis and advisory roles. As an entry-level accountant, consider the industries that interest you most and seek out projects or continuing education that can deepen your understanding and set you apart as an expert.

By setting goals across these diverse categories, entry-level accountants can create a comprehensive roadmap for their career development. Balancing the acquisition of technical knowledge with the pursuit of professional certifications, networking, soft skills enhancement, and industry specialization ensures a well-rounded and robust professional profile. This holistic approach not only fosters immediate success but also paves the way for a fulfilling and impactful career in accounting.

What Makes a Good Career Goal for a Entry Level Accountant?

In the meticulous and structured world of accounting, setting precise career goals is not just a step towards professional advancement but a cornerstone in the foundation of a successful accounting career. For Entry Level Accountants, these goals are more than just milestones; they are the catalysts that ignite a passion for numbers, foster critical thinking, and pave the way for becoming influential figures in the financial landscape.

Career Goal Criteria for Entry Level Accountants

Mastery of Accounting Principles

A paramount career goal for an Entry Level Accountant is to achieve a deep understanding and mastery of accounting principles. This knowledge is the bedrock of all accounting tasks and is essential for accurate reporting, compliance, and financial analysis. Mastery in this area ensures a solid foundation upon which to build a successful career.

Grasp GAAP and IFRS standards

Develop proficiency in tax laws

Enhance financial reporting skills

Proficiency in Accounting Software and Tools

In today's digital age, proficiency in the latest accounting software and analytical tools is a game-changer. A good career goal for an Entry Level Accountant would be to become adept in using these technologies, as they enhance efficiency, accuracy, and provide valuable insights into financial data.

Master Key Accounting Platforms

Develop Data Analysis Skills

Stay Updated on Tech Trends

Attainment of Professional Certifications

For Entry Level Accountants, setting a goal to attain professional certifications such as CPA (Certified Public Accountant) or CMA (Certified Management Accountant) is crucial. These certifications not only validate expertise but also open doors to advanced career opportunities and are a testament to one's commitment to the profession.

Research Certification Requirements

Plan for Exam Preparation

Set Timeline for Certification

Development of Soft Skills

While technical skills are vital, the development of soft skills such as communication, teamwork, and problem-solving cannot be overlooked. A well-rounded Entry Level Accountant should aim to cultivate these skills to effectively collaborate with colleagues, manage clients, and navigate the complexities of the business world.

Enhance Communication Precision

Build Collaborative Relationships

Refine Problem-Solving Techniques

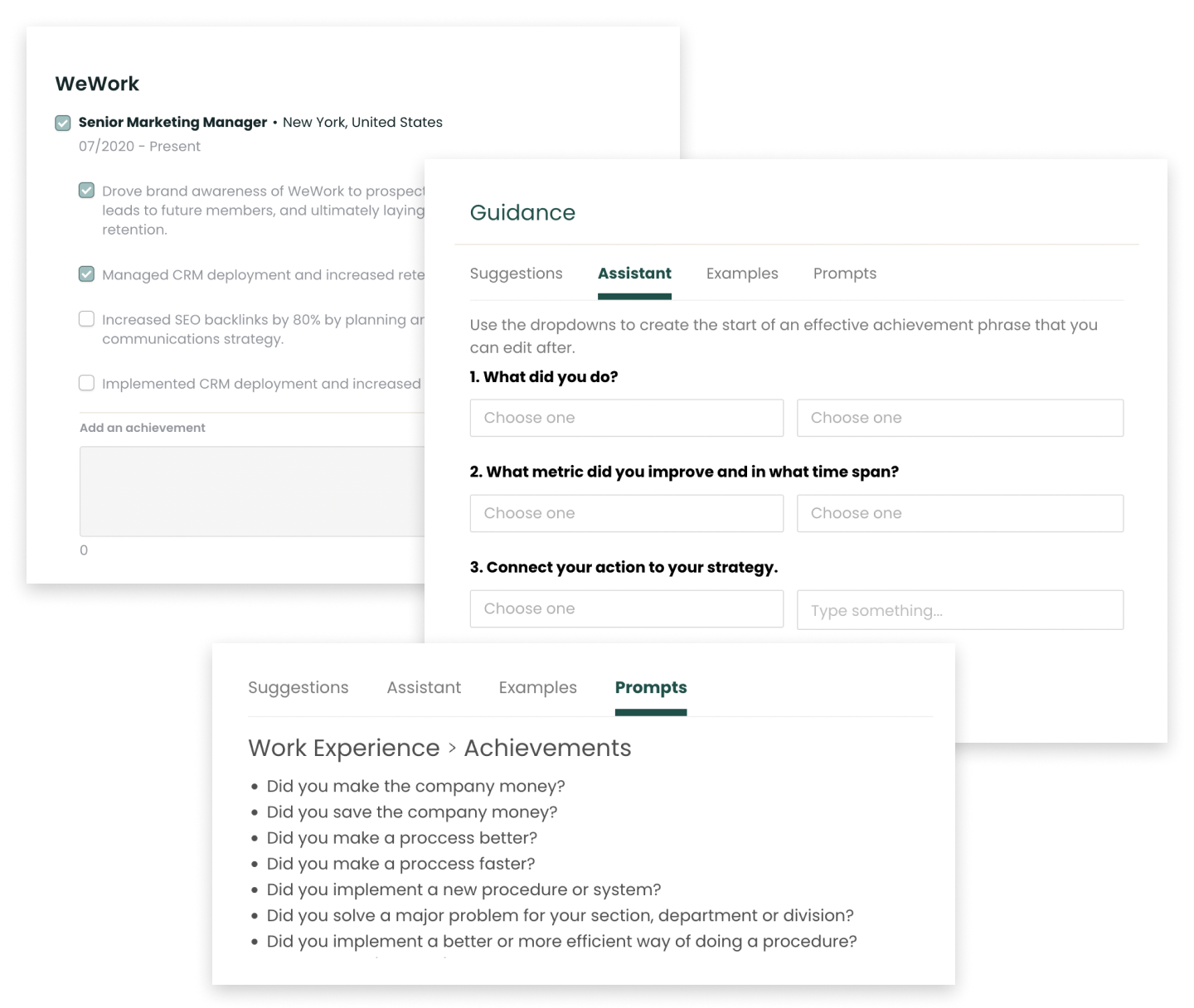

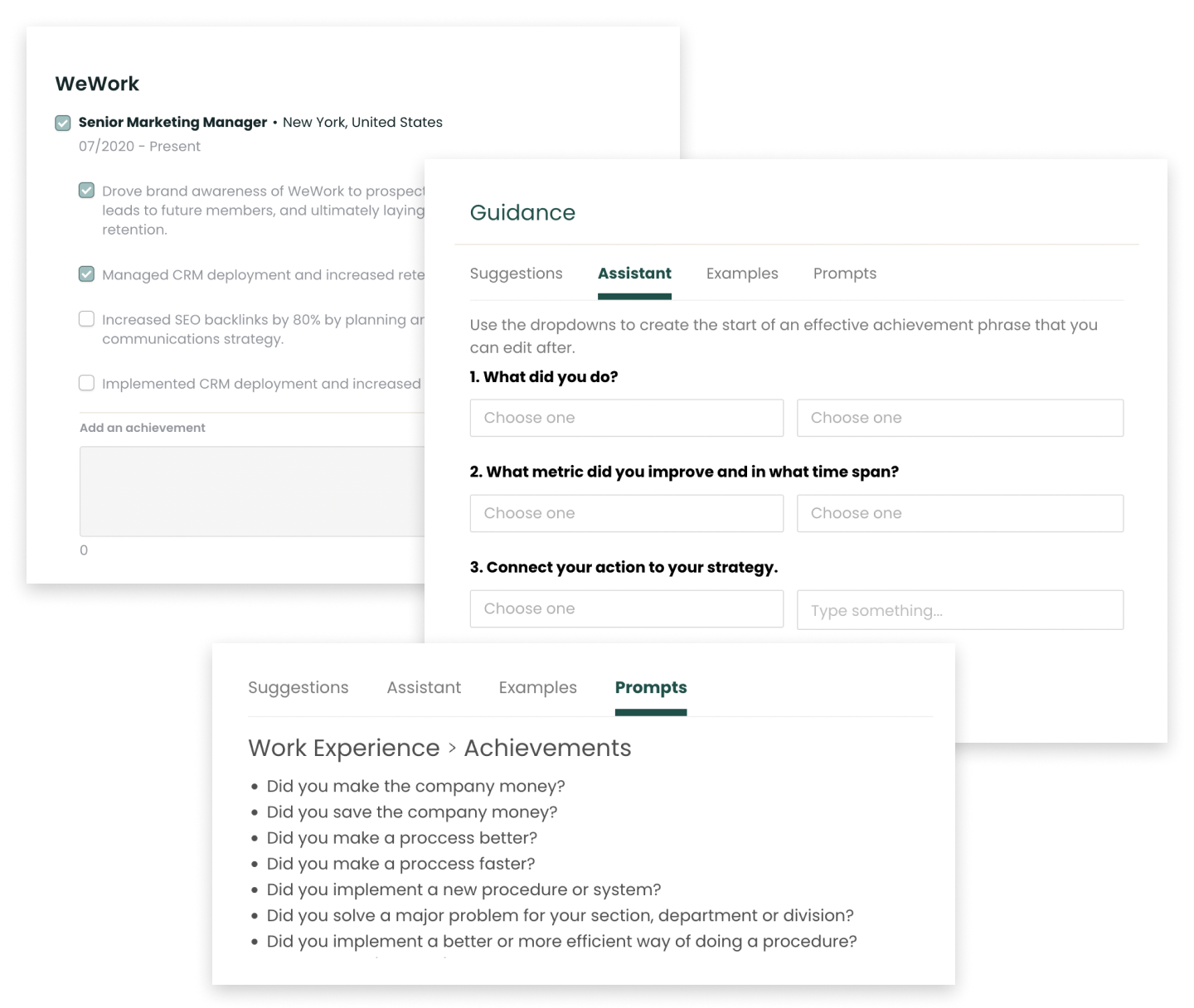

Log Your Wins Every Week with Teal

Document your career wins and achievements every week while they are fresh, then add them when you need.

Track Your Achievements for Free

12 Professional Goal Examples for Entry Level Accountants

Setting professional goals as an Entry Level Accountant is a strategic step towards shaping your career in the financial sector. These goals serve as benchmarks for personal development, enhance your performance in accounting projects, and ultimately guide your career path towards success and advancement. Below are thoughtfully selected professional goal examples for Entry Level Accountants, each designed to motivate and direct you towards significant and strategic career growth.

Master Financial Reporting and Analysis

Develop a comprehensive understanding of financial reporting standards and analysis techniques. This goal involves becoming proficient in creating accurate financial statements and performing in-depth financial analysis, which are critical skills for making informed business decisions and ensuring compliance with regulatory requirements.

Gain Proficiency in Accounting Software

Commit to learning and mastering key accounting software programs used in the industry. This goal is about enhancing efficiency and accuracy in your work, staying relevant in a technology-driven environment, and positioning yourself as a valuable asset to any accounting team.

Understand Tax Regulations

Aim to build a solid foundation in tax law and regulations. Understanding the complexities of taxation will enable you to assist in tax planning and compliance, a vital service for clients and employers, and a stepping stone to becoming a trusted tax advisor.

Enhance Communication Skills

Effective communication is essential for Entry Level Accountants. Set a goal to improve your ability to convey financial information clearly to non-financial colleagues and clients. This skill ensures that your analyses are understood and acted upon, and it strengthens your professional relationships.

Obtain a Professional Certification

Work towards earning a certification such as the CPA (Certified Public Accountant) or CMA (Certified Management Accountant). Achieving this goal will not only expand your knowledge and skills but also increase your marketability and potential for career advancement.

Develop a Specialization

Identify and cultivate a niche area within accounting, such as forensic accounting, environmental accounting, or financial planning. Specializing can differentiate you from your peers and open doors to unique opportunities in your accounting career.

Strengthen Analytical Thinking

Focus on enhancing your analytical thinking abilities. This goal is about being able to interpret data and financial information to make strategic business recommendations, a key skill that adds value to your role as an accountant.

Network with Industry Professionals

Set a goal to actively network with other accounting and finance professionals. Building a strong professional network can lead to mentorship opportunities, knowledge exchange, and potential career opportunities.

Volunteer for Diverse Projects

Seek out opportunities to work on a variety of accounting projects within your organization. This exposure will help you gain a well-rounded experience, understand different aspects of the business, and prepare you for more complex roles.

Commit to Continuous Learning

Embrace a mindset of lifelong learning by staying updated with the latest accounting standards, industry trends, and best practices. Continuous learning ensures that you remain competitive and effective in your role as regulations and technologies evolve.

Improve Time Management Skills

Developing strong time management skills is crucial for meeting deadlines and managing multiple clients or projects. Aim to refine your ability to prioritize tasks and work efficiently, which is essential for success in the fast-paced accounting field.

Advocate for Ethical Financial Practices

As an accountant, commit to upholding and advocating for ethical financial practices. This goal involves being vigilant about accuracy, transparency, and integrity in all financial reporting and advising, thereby contributing to the credibility of the profession.

Find Entry Level Accountant Openings

Explore the newest Entry Level Accountant roles across industries, career levels, salary ranges, and more.

Career Goals for Entry Level Accountants at Difference Levels

Setting career goals as an Entry Level Accountant is a strategic process that requires an understanding of where you are and where you want to be in your professional journey. As you gain experience and move up the career ladder, your objectives will naturally evolve to match your growing expertise and the increasing complexity of the challenges you face. Aligning your career goals with your current skills, challenges, and growth trajectory is essential for success and satisfaction in the accounting field.

Setting Career Goals as an Entry-Level Accountant

At the entry-level, your primary aim should be to establish a strong foundation in accounting principles and practices. Goals should include developing proficiency with accounting software, understanding regulatory standards like GAAP or IFRS, and completing tasks with accuracy and efficiency. These objectives are not just about learning the ropes; they are crucial for building the confidence and competence needed to progress in your accounting career.

Setting Career Goals as a Mid-Level Accountant

As a mid-level accountant, you've mastered the basics and are ready to take on more responsibility. Your goals should now focus on deepening your expertise in specific areas, such as tax, audit, or management accounting. Consider objectives like obtaining certifications (e.g., CPA, CMA), leading a small team, or managing a segment of the financial reporting process. At this stage, your goals should balance technical skill enhancement with developing leadership and communication abilities that are vital for further career advancement.

Setting Career Goals as a Senior-Level Accountant

Reaching the senior level means you are now an expert in your field. Your goals should reflect your ability to influence the strategic financial decisions of the organization. Aim for objectives such as developing and implementing financial strategies, mentoring and developing junior staff, or playing a key role in major financial negotiations or transactions. As a senior accountant, your goals should demonstrate not only your accounting prowess but also your leadership qualities and strategic thinking that contribute to the broader success of the business.

Leverage Feedback to Refine Your Professional Goals

Feedback is an invaluable asset for Entry Level Accountants, serving as a compass for career direction and skill enhancement. It provides a foundation for continuous improvement and helps shape a successful trajectory in the accounting field.

Embracing Constructive Criticism for Career Advancement

View constructive criticism as a roadmap to excellence. Utilize it to sharpen your accounting practices, enhance your understanding of financial regulations, and ensure your career objectives are in sync with the industry's best practices and ethical standards.

Integrating Customer Insights into Your Professional Milestones

Incorporate client feedback to fine-tune your client service approach. Align your career goals with delivering exceptional financial advice and services that cater to client needs, thereby fostering trust and establishing a reputation for reliability in the accounting sphere.

Utilizing Performance Reviews to Set Targeted Goals

Leverage performance reviews to pinpoint areas for professional development and to recognize your strengths. Craft specific, measurable goals based on this feedback to pursue targeted skill development, such as mastering new accounting software or obtaining additional certifications relevant to your field.

Goal FAQs for Entry Level Accountants

How frequently should Entry Level Accountants revisit and adjust their professional goals?

Entry Level Accountants should reassess their professional goals biannually to stay attuned to industry trends, regulatory changes, and personal skill development. This semi-annual check-in fosters adaptability and ensures goals are in sync with evolving accounting standards, technological advancements, and potential career progression opportunities within the financial sector.

Can professional goals for Entry Level Accountants include soft skill development?

Certainly. For Entry Level Accountants, soft skills such as effective communication, problem-solving, and adaptability are essential. Developing these skills can improve client interactions, facilitate cross-departmental teamwork, and enhance the ability to interpret and convey complex financial information. Therefore, incorporating soft skill development into professional goals is not only appropriate but also vital for career progression and success in the accounting field.

How do Entry Level Accountants balance long-term career goals with immediate project deadlines?

Entry Level Accountants can harmonize immediate deadlines with long-term career ambitions by prioritizing efficiency and continuous learning. They should approach each task as an opportunity to hone skills crucial for advancement, such as analytical thinking and attention to detail. By setting personal milestones that complement project timelines, they can ensure that meeting today's objectives also builds the foundation for tomorrow's career achievements.

How can Entry Level Accountants ensure their goals align with their company's vision and objectives?

Entry Level Accountants can align their goals with their company's vision by actively engaging in professional development opportunities that enhance their accounting expertise in areas critical to the company's financial strategy. Regular discussions with mentors and supervisors about the firm's financial objectives can guide their focus on projects and skills that support organizational growth, ensuring a symbiotic progression of individual and company success.

Up Next

What is a Entry Level Accountant?

Learn what it takes to become a JOB in 2024