Why Every Fintech Product Manager Should Have Goals

In the dynamic realm of Fintech, setting clear, actionable goals isn't just advantageous; it's indispensable. Goals serve as the career compass for Fintech Product Managers, steering every strategic decision, innovation, and leadership initiative. They provide a definitive vision of success, ensuring that each effort aligns with broader objectives and contributes to both personal and organizational growth. For Fintech Product Managers, well-defined goals are the bedrock of career progression, fostering a culture of innovation and strategic foresight. They offer direction and clarity in daily responsibilities and long-term aspirations, enabling professionals to navigate the complexities of the financial technology landscape with precision and confidence.

Moreover, goal-setting enhances the ability to lead teams effectively, ensuring that individual and collective efforts are harmonized with the organization's vision. By aligning personal goals with team objectives, Fintech Product Managers can drive cohesive and impactful outcomes, fostering a collaborative environment that thrives on shared success. In this high-stakes industry, where rapid technological advancements and regulatory changes are the norm, having specific and measurable goals is crucial. They not only propel career advancement but also empower Fintech Product Managers to spearhead innovation, strategic planning, and leadership, ultimately shaping the future of financial technology.

Different Types of Career Goals for Fintech Product Managers

In the dynamic and rapidly evolving field of Fintech, career goals for Product Managers can be as varied as the innovative solutions they develop. Understanding the different types of career goals enables professionals to create a balanced approach for their career development, aligning both short-term project achievements and long-term career objectives. This holistic strategy ensures that each milestone reached is a step towards a fulfilling and impactful career.

Technical Proficiency Goals

Technical proficiency goals are essential for staying ahead in the Fintech industry. These goals might include gaining expertise in blockchain technology, becoming proficient in data analytics tools, or understanding the intricacies of financial regulations. By continuously enhancing your technical skills, you ensure that you can effectively navigate the complexities of Fintech products and deliver cutting-edge solutions.

Strategic Vision and Planning Goals

Strategic vision goals focus on your ability to foresee market trends and plan accordingly. This could involve developing a deep understanding of market dynamics, customer needs, and competitive landscapes. Setting goals to refine your strategic planning skills ensures that you can craft long-term product roadmaps that align with both company objectives and market demands, positioning your products for sustained success.

Customer-Centric Goals

Customer-centric goals emphasize the importance of understanding and prioritizing user needs. These goals might include improving user experience (UX) design skills, conducting in-depth user research, or implementing customer feedback loops. By focusing on the customer, you ensure that your products not only meet but exceed user expectations, fostering loyalty and driving growth.

Regulatory and Compliance Goals

In the highly regulated Fintech industry, understanding and adhering to compliance standards is crucial. Goals in this area might involve staying updated with the latest financial regulations, obtaining relevant certifications, or developing robust compliance frameworks. Mastery in regulatory and compliance matters ensures that your products are not only innovative but also legally sound and trustworthy.

Networking and Industry Engagement Goals

Networking goals are about building and leveraging professional relationships within the Fintech ecosystem. This could involve attending industry conferences, participating in Fintech forums, or collaborating with other professionals on innovative projects. Strong industry connections can open doors to new opportunities, provide valuable insights, and enhance your influence within the Fintech community.

By setting and pursuing these diverse career goals, Fintech Product Managers can ensure a well-rounded and progressive career trajectory. This balanced approach not only fosters immediate project successes but also paves the way for long-term professional growth and industry leadership.

What Makes a Good Career Goal for a Fintech Product Manager?

In the fast-paced and ever-evolving world of fintech, well-defined career goals are essential for Product Managers aiming to excel. These goals not only drive professional advancement but also foster the development of strategic thinking, leadership, and innovation. By setting clear and meaningful objectives, Fintech Product Managers can navigate their careers with purpose and precision, ensuring they remain at the forefront of industry advancements.

Career Goal Criteria for Fintech Product Managers

Specificity and Clarity

A strong career goal for a Fintech Product Manager is specific and clear, detailing exactly what you aim to achieve and how you plan to get there. This precision transforms broad ambitions into actionable steps, making it easier to track progress and measure success. In the fintech sector, where precision and accuracy are paramount, having clear goals ensures that your efforts are focused and impactful.

Identify Key Market Trends

Set Regulatory Compliance Goals

Define User Experience Metrics

Alignment with Industry Trends

Given the rapid evolution of fintech, your career goals should align with current and emerging industry trends. This alignment ensures that your professional development is relevant and forward-thinking, positioning you as a leader who can anticipate and leverage technological advancements. Staying attuned to trends such as blockchain, AI, and digital banking can significantly enhance your strategic value.

Monitor Regulatory Changes

Adopt Emerging Technologies

Engage with Fintech Communities

Customer-Centric Focus

Effective career goals for Fintech Product Managers prioritize the needs and experiences of customers. By centering your objectives around delivering exceptional value to users, you not only drive product success but also build a reputation as a customer-focused leader. In a sector where user trust and satisfaction are critical, this focus can differentiate you and your products in the market.

Identify User Pain Points

Develop User-Centric Solutions

Measure Customer Satisfaction

Measurable Impact

Good career goals are measurable, allowing you to quantify your achievements and demonstrate your impact. Whether it's increasing user adoption rates, improving transaction speeds, or enhancing security features, having quantifiable targets provides a clear benchmark for success. This measurability is crucial in fintech, where data-driven decision-making is key.

Track User Engagement

Monitor Transaction Efficiency

Evaluate Security Enhancements

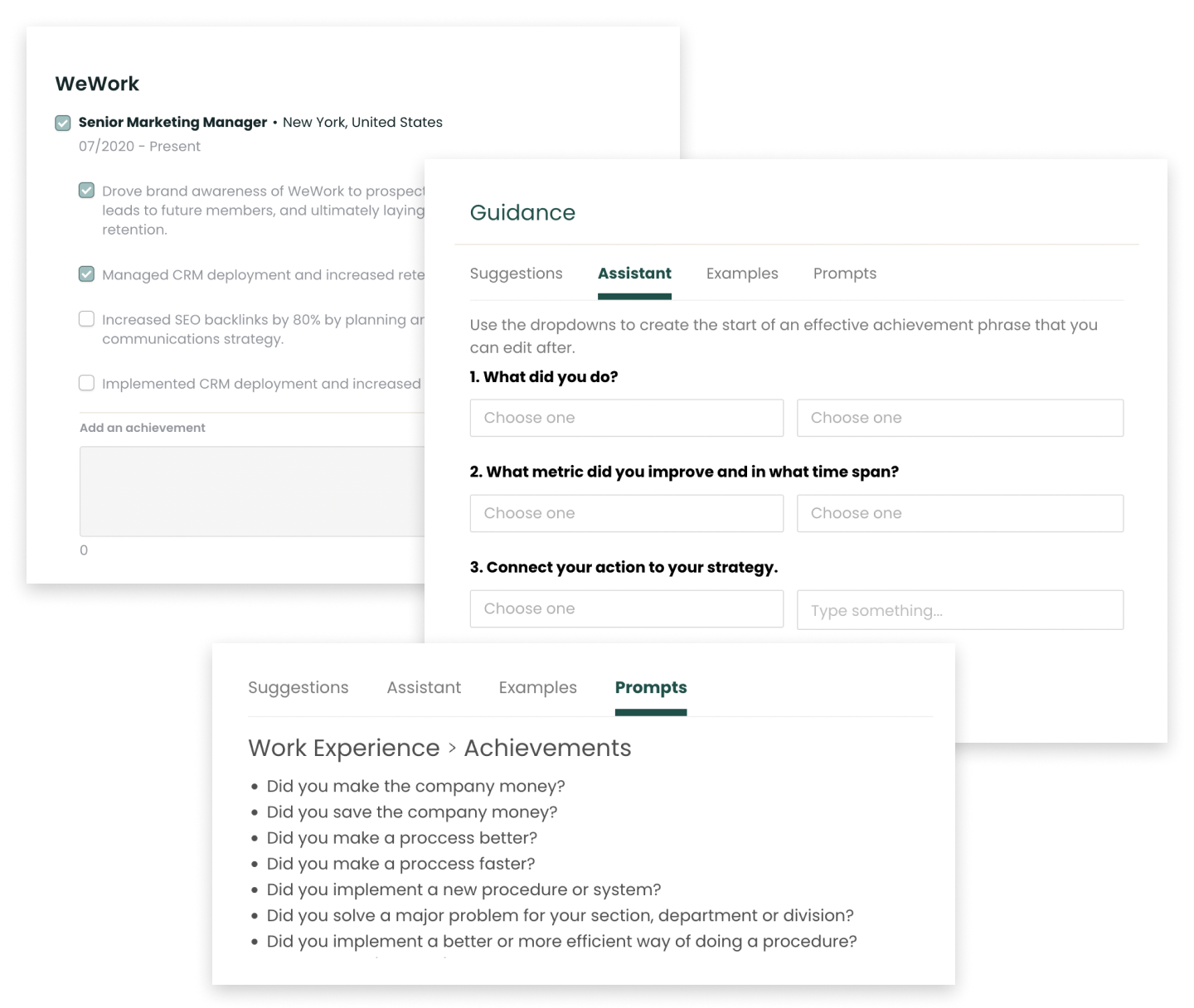

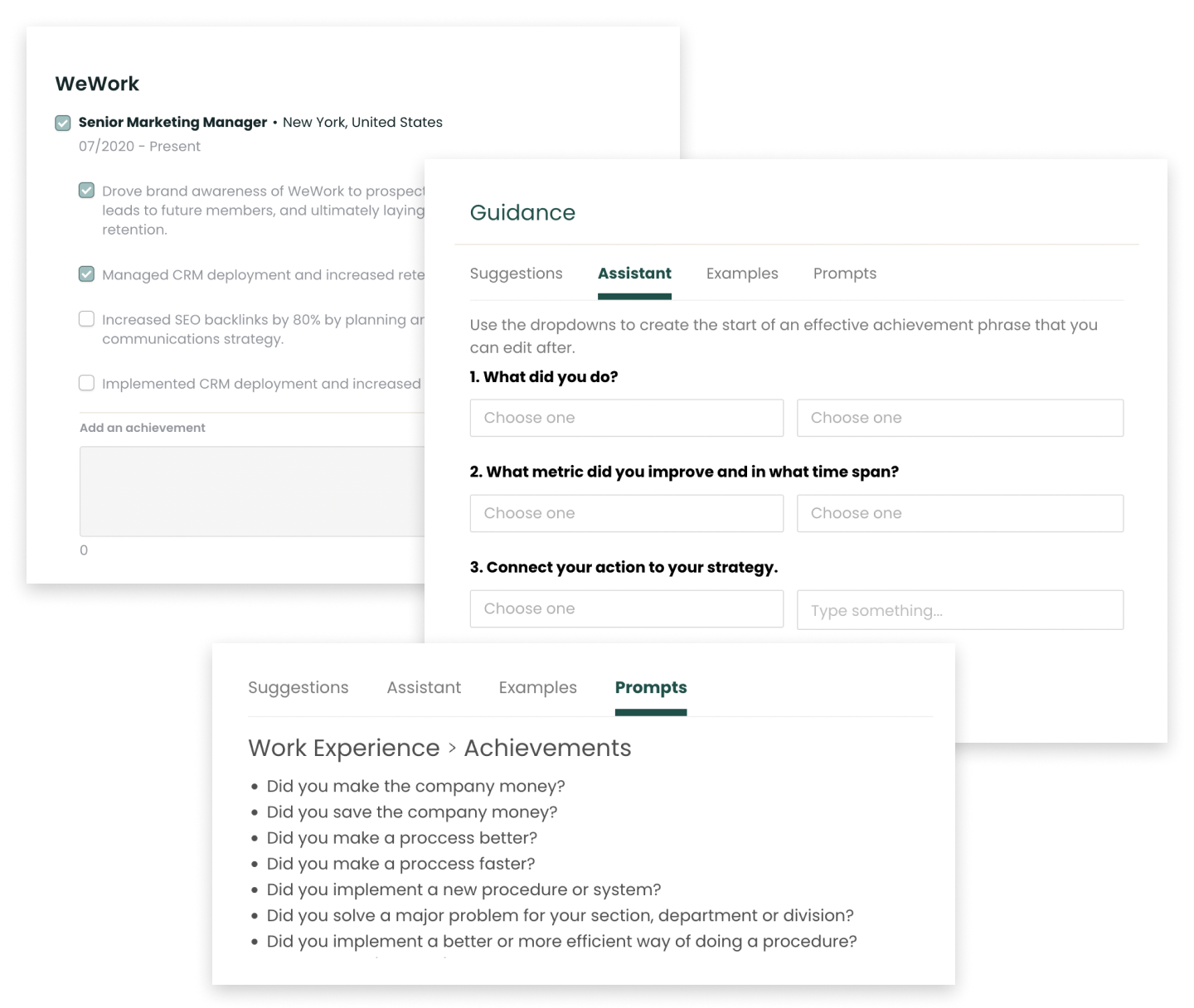

Log Your Wins Every Week with Teal

Document your career wins and achievements every week while they are fresh, then add them when you need.

Track Your Achievements for Free

12 Professional Goal Examples for Fintech Product Managers

Setting professional goals is not just about climbing the career ladder; it's about steering your career in the right direction with intention and purpose. For Fintech Product Managers, goals can define the trajectory of their product, their team, and their personal development in the industry. Below are carefully curated examples of professional goals that resonate with the ethos of a Fintech Product Manager, each aimed to inspire and propel PMs towards meaningful and strategic career advancement.

Enhance Regulatory Compliance Knowledge

In the highly regulated fintech industry, understanding compliance is crucial. Aim to deepen your knowledge of financial regulations, data privacy laws, and industry standards. This expertise ensures that your products not only meet legal requirements but also build trust with users and stakeholders.

Drive Financial Inclusion Initiatives

Commit to developing products that promote financial inclusion. This goal involves identifying underserved markets, understanding their unique needs, and creating solutions that provide accessible financial services. A Fintech Product Manager who champions financial inclusion can make a significant social impact while expanding market reach.

Master Blockchain and Cryptocurrency Technologies

Stay ahead in the fintech space by mastering emerging technologies like blockchain and cryptocurrencies. Set a goal to understand their underlying principles, potential applications, and regulatory landscape. This knowledge positions you to innovate and lead in a rapidly evolving sector.

Optimize User Experience through Data Analytics

Leverage data analytics to enhance user experience. Aim to master tools and techniques for analyzing user behavior, transaction patterns, and feedback. This proficiency allows you to make data-driven decisions that improve product usability and customer satisfaction.

Lead a Digital Transformation Project

Take the helm of a digital transformation initiative within your organization. This goal will challenge you to modernize legacy systems, integrate new technologies, and streamline operations. Successfully leading such a project demonstrates your ability to drive significant organizational change.

Develop Expertise in AI and Machine Learning

Artificial intelligence and machine learning are transforming fintech. Set a goal to gain expertise in these areas, understanding how they can be applied to enhance product features like fraud detection, personalized financial advice, and automated customer service. This knowledge keeps you at the forefront of innovation.

Achieve a Fintech-Specific Certification

Earning a certification in fintech, such as Certified Fintech Professional (CFP) or a related domain, can be a tangible milestone in your career. It not only broadens your skillset but also showcases your commitment to professional development and staying ahead in the industry.

Foster a Culture of Innovation

As a Fintech Product Manager, you're at the helm of your team's culture. Set a goal to cultivate a culture of innovation by encouraging creative thinking, supporting experimentation, and rewarding innovative ideas. A thriving, innovative team directly translates to cutting-edge products.

Build Strategic Partnerships with Financial Institutions

Expand your product's reach and your professional network by forging strategic partnerships with banks, credit unions, and other financial institutions. This goal involves identifying potential partners, negotiating collaborations, and managing partnership programs. Such alliances can provide valuable resources and market insights.

Implement Agile Methodologies

Find Fintech Product Manager Openings

Explore the newest Fintech Product Manager roles across industries, career levels, salary ranges, and more.

Career Goals for Fintech Product Managers at Difference Levels

Setting career goals is not a one-size-fits-all affair, especially in the dynamic role of a Fintech Product Manager. Recognizing where you stand in your career journey is crucial for tailoring your aspirations and objectives. Whether you're just starting, are in the midst of your career, or have reached a senior level, your goals should reflect your current skills, challenges, and growth trajectory. In this section, we explore how Fintech Product Managers at different stages of their careers can set meaningful and impactful goals, ensuring each milestone paves the way for professional advancement and success.

Setting Career Goals as an Entry-Level Fintech Product Manager

At the entry-level, your focus should be on building a solid foundation in the fintech landscape. Aim for goals that enhance your understanding of financial technologies, regulatory environments, and customer needs. Consider setting objectives like mastering the basics of Agile methodologies, contributing to user research specific to fintech products, or successfully managing a small feature from ideation to launch. These goals are not just about ticking boxes but are stepping stones to gaining confidence and clarity in your role as a Fintech Product Manager.

Setting Career Goals as a Mid-Level Fintech Product Manager

As a mid-level Fintech Product Manager, you're beyond the basics. Your goals should now push you towards leadership and strategic influence within the fintech domain. Focus on objectives that refine your decision-making and cross-functional communication skills. Consider leading a major product initiative that addresses a key financial pain point, driving a user experience overhaul based on customer feedback, or mentoring junior team members. At this stage, your goals should reflect a balance between delivering tangible product successes and enhancing your personal growth and influence within the team.

Setting Career Goals as a Senior-Level Fintech Product Manager

At the senior level, you are a visionary in the fintech space. Your goals should extend beyond the product itself and encompass broader business impacts and team leadership. Aim for objectives like establishing a new strategic direction for the product line that aligns with market trends, fostering a culture of innovation and excellence within your team, or building influential industry partnerships. As a senior Fintech Product Manager, your goals should not only represent your expertise and vision but also your capacity to shape the industry and drive meaningful change.

Leverage Feedback to Refine Your Professional Goals

Feedback is crucial for Fintech Product Managers, not just for product improvement but also for personal and professional growth. Effective use of feedback can transform a Fintech PM's career trajectory.

Embracing Constructive Criticism for Career Advancement

See criticism as a growth opportunity. Use it to refine your fintech product management approach, improve leadership skills, and ensure your goals align with the evolving demands of the fintech industry. Regularly seek out constructive criticism from colleagues and mentors to identify areas for improvement and to stay ahead in a rapidly changing market.

Integrating Customer Insights into Your Professional Milestones

Regularly analyze customer feedback and market trends. Align your career goals with creating fintech products that meet user needs and market demands. Use customer insights to identify gaps in your knowledge or skills and set specific learning objectives to address them, ensuring your professional growth is directly tied to delivering value to your customers.

Utilizing Performance Reviews to Set Targeted Goals

Use performance reviews to identify improvement areas and strengths. Set specific goals based on this feedback for continuous professional development and strategic alignment. Performance reviews can highlight your achievements and areas needing attention, helping you to focus on developing skills that will enhance your effectiveness and career progression in the fintech sector.

Goal FAQs for Fintech Product Managers

How frequently should Fintech Product Managers revisit and adjust their professional goals?

Fintech Product Managers should revisit and adjust their professional goals every six months. This frequency allows them to stay attuned to the rapidly evolving financial technology landscape, regulatory changes, and emerging market trends. Regular reflection ensures they can pivot strategies effectively, align with organizational objectives, and foster continuous personal and professional growth in this dynamic field.

Can professional goals for Fintech Product Managers include soft skill development?

Absolutely. For Fintech Product Managers, soft skills like adaptability, problem-solving, and effective communication are essential. These skills enable better navigation of complex regulatory environments, foster innovation, and enhance collaboration with cross-functional teams. Setting goals to develop these soft skills can significantly improve stakeholder relationships, drive user-centric product development, and ultimately contribute to the success of fintech solutions in a rapidly evolving industry.

How do Fintech Product Managers balance long-term career goals with immediate project deadlines?

Balancing long-term goals with immediate deadlines requires strategic foresight and adaptability. Fintech Product Managers should integrate their career aspirations into daily tasks by prioritizing projects that enhance their industry knowledge and technical skills. Leveraging agile methodologies and continuous learning ensures that each project not only meets deadlines but also contributes to long-term career growth, fostering a balance between immediate demands and future ambitions.

How can Fintech Product Managers ensure their goals align with their company's vision and objectives?

Fintech Product Managers should engage in continuous dialogue with leadership and key stakeholders to grasp the company's strategic goals. By integrating insights from market trends and regulatory landscapes, they can align their product roadmaps with the company's vision. Regularly revisiting these goals ensures that their initiatives not only drive personal career growth but also advance the company's mission, fostering innovation and a unified direction.

Up Next

What is a Fintech Product Manager?

Learn what it takes to become a JOB in 2024