CV Writing for Tax Consultants

As a Tax Consultant, your CV should be a testament to your expertise in tax laws, regulations, and compliance. It should highlight your analytical skills, attention to detail, and your ability to provide strategic tax advice. An impactful CV will demonstrate your proficiency in tax planning and compliance, and your ability to deliver value to businesses and individuals.

Whether you're targeting roles in corporate tax, international tax, or personal tax consulting, these guidelines will help you craft a CV that captures the attention of potential employers.

Highlight Your Tax Certifications and Specializations: Mention qualifications like Enrolled Agent (EA), Certified Public Accountant (CPA), or Chartered Tax Advisor (CTA). If you have a specialization in a specific area of tax, such as international tax or estate planning, make sure to include this early in your CV.

Showcase Your Tax Consulting Achievements: Use specific numbers to highlight your impact, such as "Reduced client's tax liability by 30% through strategic tax planning" or "Identified tax savings of $500,000 through thorough compliance review".

Align Your CV with the Job Description: Tailor your CV to match the specific requirements of the job. If the role emphasizes tax planning, highlight your experience and achievements in this area.

Detail Your Proficiency in Tax Software: List your expertise in tax software like TurboTax, H&R Block, or TaxAct. Also, mention any experience with accounting software like QuickBooks or Xero.

Emphasize Communication and Client Service Skills: Tax consulting requires excellent communication and client service skills. Provide examples of how you've effectively communicated complex tax information to clients or how you've provided exceptional client service.

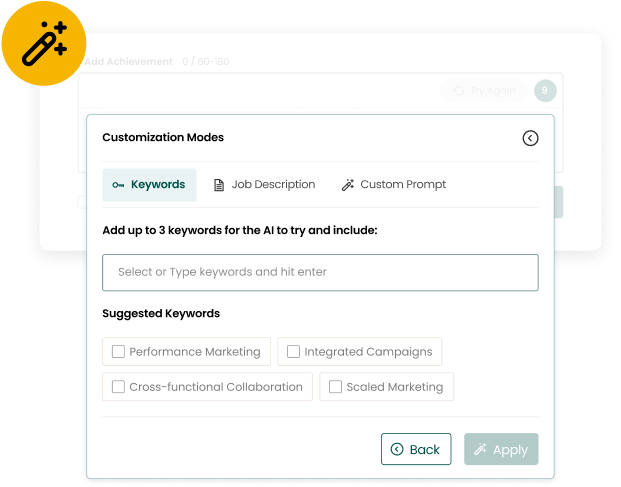

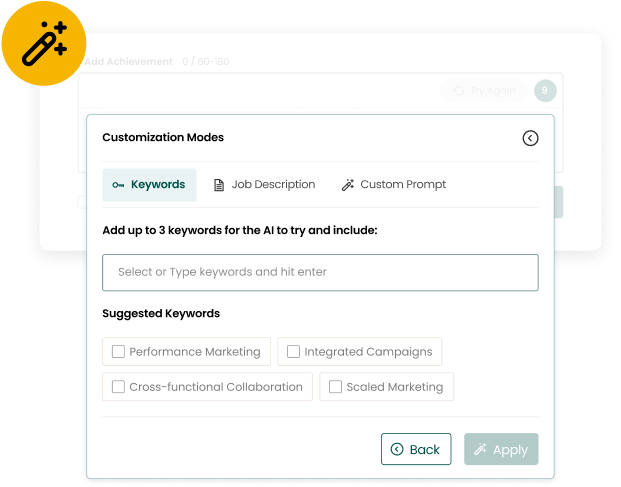

The Smarter, Faster Way to Write Your CV

Craft your summaries and achievements more strategically in less than half the time.

Revamp your entire CV in under 5 minutes.

Write Your CV with AI

Jack Campbell

Florida

•

(840) 739-6433

•

•

linkedin.com/in/jack-campbell

Highly proficient Tax Consultant with extensive experience in managing multinational tax strategies, reducing liabilities by 20%, and providing tailored advice to high-net-worth clients, resulting in an average of 15% in tax savings. Proven success in leading teams to achieve a 100% success rate in tax audits and implementing tax software systems that enhance efficiency by 30%. Skilled in resolving complex tax disputes, reducing client tax penalties by 30%, I am eager to leverage my expertise to optimize tax processes for my next team.

Tax Consultant• 01/2024 – Present

PivotSphere Tech Services

Orchestrated a comprehensive tax strategy for a multinational corporation, resulting in a 20% reduction in global tax liabilities through the effective use of international tax treaties and credits.

Managed a portfolio of high-net-worth clients, providing tailored tax advice that led to an average of 15% in tax savings per client.

Implemented a new tax software system, improving the efficiency of tax return preparation by 30% and reducing errors by 25%.

Senior Tax Analyst• 03/2023 – 12/2023

Tax Associate• 11/2021 – 03/2023

SKILLS

Expertise in international tax treaties and credits

High-net-worth tax advisory

Proficiency in tax software systems

Leadership and mentorship

Strategic tax planning

Research skills in complex tax issues

Experience in managing tax compliance

Expertise in conducting detailed tax audits

Ability to identify overlooked tax credits and deductions

Experience in resolving complex tax disputes

EDUCATION

Bachelor of Science in Accounting

University of Richmond

Richmond, VA

2016-2020

CERTIFICATIONS

Certified Tax Coach (CTC)

04/2024

American Institute of Certified Tax Coaches (AICTC)

Enrolled Agent (EA)

04/2023

Internal Revenue Service (IRS)

Certified Public Accountant (CPA)

04/2022

American Institute of Certified Public Accountants (AICPA)

Landon Whitfield

Florida

•

(736) 482-1957

•

•

linkedin.com/in/landon-whitfield

Highly skilled Tax Advisor with extensive experience in developing effective tax strategies, reducing corporate liabilities by 20%, and ensuring international compliance. Proven track record in conducting detailed tax audits, identifying over $1 million in potential savings, and managing tax-related risks. With a passion for mentorship and a commitment to staying abreast of changing tax laws, I am ready to leverage my expertise to drive financial efficiency and compliance in a dynamic team.

Tax Advisor• 01/2024 – Present

Quantum Analytics Solutions

Implemented a comprehensive tax strategy that resulted in a 20% reduction in corporate tax liabilities, through the effective use of tax credits and deductions.

Advised on complex international tax issues, leading to a 15% decrease in potential tax penalties and ensuring compliance with multiple jurisdictions.

Managed a team of junior tax advisors, providing mentorship and guidance that improved team productivity by 30%.

Senior Tax Analyst• 03/2023 – 12/2023

IronGate Capital Management

Tax Consultant• 11/2021 – 03/2023

Precision Capital Management

SKILLS

Expertise in implementing comprehensive tax strategies

Knowledge of international tax regulations and compliance

Team management and mentorship abilities

Proficiency in conducting detailed tax audits

Ability to identify and apply tax savings for clients

Experience in developing and implementing tax risk management systems

Collaborative skills in ensuring compliance with new tax regulations

Expertise in providing tax advice to small businesses

Efficiency in streamlining tax filing processes

Proficiency in conducting tax research and analysis

EDUCATION

Bachelor of Science in Accounting

University of Richmond

Richmond, VA

2016-2020

CERTIFICATIONS

Certified Public Accountant (CPA)

04/2024

American Institute of Certified Public Accountants (AICPA)

Enrolled Agent (EA)

04/2023

Internal Revenue Service (IRS)

Certified Tax Coach (CTC)

04/2022

American Institute of Certified Tax Coaches (AICTC)

Enhance your writing process and tailor every CV to the job description.

Build your CV

CV Structure & Format for Tax Consultants

Crafting a Tax Consultant's CV requires a strategic approach to structure and formatting. This is not only to highlight the key information employers find most relevant, but also to reflect the analytical and organizational skills inherent to the profession. The right CV structure arranges and highlights the most critical career details, ensuring your accomplishments in tax consultancy are displayed prominently.

By focusing on essential sections and presenting your information effectively, you can significantly impact your chances of securing an interview. Let's explore how to organize your CV to best showcase your tax consultancy career.

Essential CV Sections for Tax Consultants

Every Tax Consultant's CV should include these core sections to provide a clear, comprehensive snapshot of their professional journey and capabilities:

1. Personal Statement: A concise summary that captures your qualifications, tax consultancy expertise, and career goals.

2. Career Experience: Detail your professional history in tax consultancy, emphasizing responsibilities and achievements in each role.

3. Education: List your academic background, focusing on tax-related degrees and other relevant education.

4. Certifications: Highlight important tax consultancy certifications such as CTA, EA, or ATP that enhance your credibility.

5. Skills: Showcase specific tax consultancy skills, including software proficiencies (e.g., TurboTax, H&R Block) and other technical abilities.

Optional Sections

To further tailor your CV and distinguish yourself, consider adding these optional sections, which can offer more insight into your professional persona:

1. Professional Affiliations: Membership in tax consultancy bodies like the AICPA or NATP can underline your commitment to the field.

2. Projects: Highlight significant tax consultancy projects or audits you've led or contributed to, showcasing specific expertise or achievements.

3. Awards and Honors: Any recognition received for your work in tax consultancy can demonstrate excellence and dedication.

4. Continuing Education: Courses or seminars that keep you at the forefront of tax laws and technology.

Getting Your CV Structure Right

For Tax Consultants, an effectively structured CV is a testament to the order and precision inherent in the profession. Keep these tips in mind to refine your CV’s structure:

Logical Flow: Begin with a compelling personal statement, then proceed to your professional experience, ensuring a logical progression through the sections of your CV.

Highlight Key Achievements Early: Make significant accomplishments stand out by placing them prominently within each section, especially in your career experience.

Use Reverse Chronological Order: List your roles starting with the most recent to immediately show employers your current level of responsibility and expertise.

Keep It Professional and Precise: Opt for a straightforward, professional layout and concise language that reflects the precision tax consultancy demands.

Personal Statements for Tax Consultants

The personal statement in a Tax Consultant's CV is a crucial element that sets the tone for the entire document. It's an opportunity to highlight your unique professional attributes, your passion for tax consultancy, and your career aspirations. It should succinctly outline your career goals, key skills, and the unique value you can bring to potential employers. Let's examine the differences between strong and weak personal statements for Tax Consultants.

Tax Consultant Personal Statement Examples

Strong Statement

"Highly skilled and certified Tax Consultant with over 7 years of experience in tax planning, compliance, and advisory services. Proven track record in delivering tax-efficient solutions and strategies that enhance profitability. Passionate about using my analytical skills to provide insightful tax advice and support strategic business decisions. Eager to bring my expertise in tax law and financial planning to a dynamic team."

Weak Statement

"I am a Tax Consultant with experience in tax planning and compliance. I enjoy working with numbers and am looking for a new opportunity to apply my skills. I have a good understanding of tax laws and have helped businesses with their tax strategies."

Strong Statement

"Dynamic Tax Consultant specializing in corporate tax, international tax, and tax risk management. With a solid background in both public and private sectors, I excel at developing tax strategies and managing tax liabilities with utmost precision. Committed to providing expert tax advice and robust analytical insights to a forward-thinking organization."

Weak Statement

"Experienced in various tax consultancy tasks, including tax planning and risk management. Familiar with corporate and international tax laws. Looking for a role where I can use my tax consultancy knowledge and improve tax processes."

How to Write a Statement that Stands Out

Clearly articulate your achievements and skills, emphasizing measurable impacts. Tailor your statement to reflect the job’s requirements, showcasing how your expertise addresses industry-specific challenges.CV Career History / Work Experience

The experience section of your Tax Consultant CV is a powerful tool to showcase your professional journey and accomplishments. It's where you can provide detailed, quantifiable examples of your past responsibilities and achievements, significantly enhancing your appeal to prospective employers. Below are examples to guide you in distinguishing between impactful and less effective experience descriptions.

Tax Consultant Career Experience Examples

Strong

"Highly skilled and certified Tax Consultant with over 7 years of experience in tax planning, compliance, and advisory services. Proven track record in delivering tax-efficient solutions and strategies that enhance profitability. Passionate about using my analytical skills to provide insightful tax advice and support strategic business decisions. Eager to bring my expertise in tax law and financial planning to a dynamic team."

Weak

"I am a Tax Consultant with experience in tax planning and compliance. I enjoy working with numbers and am looking for a new opportunity to apply my skills. I have a good understanding of tax laws and have helped businesses with their tax strategies."

Strong

"Dynamic Tax Consultant specializing in corporate tax, international tax, and tax risk management. With a solid background in both public and private sectors, I excel at developing tax strategies and managing tax liabilities with utmost precision. Committed to providing expert tax advice and robust analytical insights to a forward-thinking organization."

Weak

"Experienced in various tax consultancy tasks, including tax planning and risk management. Familiar with corporate and international tax laws. Looking for a role where I can use my tax consultancy knowledge and improve tax processes."

How to Make Your Career Experience Stand Out

To make your career experience stand out, focus on quantifiable achievements and specific projects that showcase your skills and impact. Tailor your experience to the Tax Consultant role by highlighting expertise in areas like tax planning, IRS representation, and tax law updates that directly contributed to client satisfaction and retention.CV Skills & Proficiencies for Tax Consultant CVs

The experience section of your Tax Consultant CV is a powerful tool to showcase your professional journey and accomplishments. It's where you can provide detailed, quantifiable examples of your past responsibilities and achievements, significantly enhancing your appeal to prospective employers. Below are examples to guide you in distinguishing between impactful and less effective experience descriptions.

CV Skill Examples for Tax Consultants

Technical Expertise:

Tax Law Knowledge: Comprehensive understanding of local, state, and federal tax laws, and the ability to apply this knowledge to client situations.

Tax Planning & Strategy: Proficiency in developing effective tax strategies to optimize clients' financial situations and ensure compliance.

Tax Software Proficiency: Skilled in using tax software (e.g., TurboTax, H&R Block) to streamline tax preparation and filing processes.

Financial Analysis: Ability to interpret financial data and provide insightful tax advice based on the analysis.Interpersonal & Collaboration Skills

Interpersonal Strengths and Collaborative Skills:

Client Relationship Management: Ability to build and maintain strong relationships with clients, providing excellent service and ensuring client satisfaction.

Teamwork & Collaboration: Proven ability to work effectively within a team, coordinating efforts to meet deadlines and achieve goals.

Problem-Solving: Innovative approach to resolving tax issues and discrepancies, ensuring client satisfaction and compliance.

Adaptability: Flexibility in adapting to changes in tax laws and regulations, as well as changes within the organization.

Creating a Powerful Skills Section on Your CV

Align your technical expertise and interpersonal skills with the specific requirements of the Tax Consultant role you're targeting. Where possible, quantify your achievements and illustrate your skills with real-world examples from your career. Tailoring your CV to reflect the specific needs of potential employers can significantly enhance your candidacy and set you apart from the competition.How to Tailor Your Tax Consultant CV to a Specific Job

Tailoring your CV to the target job opportunity should be your single most important focus when creating a CV.

Tailoring your CV for each Tax Consultant role is not just a good idea—it's a necessity. By customizing your CV, you can highlight your most relevant skills and experiences, aligning them with the employer's needs and significantly enhancing your chances of landing the job.

Focus on Relevant Tax Consultancy Experiences

Identify and emphasize experiences that directly align with the job's requirements. If the role requires expertise in international tax laws, highlight your experiences in this area. This level of specificity shows your suitability and readiness for the challenges that the new role may present.

Use Industry-Specific Keywords

Mirror the language used in the job posting in your CV. This will help your CV pass through Applicant Tracking Systems (ATS) and signal to hiring managers that you are a perfect fit for the role. Including key terms like "tax compliance" or "tax planning" can directly link your experience with the job's demands.

Highlight Your Technical Skills and Certifications

Showcase the technical skills and certifications that are particularly valued in the Tax Consultant field. If the job requires proficiency in tax software like TurboTax or H&R Block, make sure to highlight your expertise in these areas. Similarly, if you hold certifications like Certified Public Accountant (CPA) or Enrolled Agent (EA), place them prominently on your CV.

Align Your Professional Summary with the Job Requirements

Ensure your professional summary or personal statement directly reflects the qualifications and attributes sought in the Tax Consultant position. A concise mention of your relevant experiences, skills, and achievements can make a powerful first impression, immediately showcasing your alignment with the role.

Present Your Soft Skills and Collaborative Experiences

Tax Consultants often work in teams and deal with clients directly. Highlight your experiences in collaborative environments and your soft skills like communication, problem-solving, and client relationship management. Align these with the job specifications to show your ability to thrive in similar settings.CV FAQs for Tax Consultants

How long should Tax Consultants make a CV?

The ideal length for a Tax Consultant's CV is 1-2 pages. This allows enough room to showcase your tax expertise and qualifications without overloading with unnecessary details. Prioritize clarity and relevance, emphasizing your most notable tax-related accomplishments that reflect your competence and success in roles similar to the ones you're aiming for.

What's the best format for an Tax Consultant CV?

The best format for a Tax Consultant CV is the reverse-chronological format. This layout emphasizes your most recent tax consulting experiences and achievements, demonstrating your career progression in the field. It allows potential employers to quickly assess your expertise and growth in tax consultancy. Ensure each section highlights your tax-specific skills, certifications, and accomplishments, aligning them with the job requirements.

How does a Tax Consultant CV differ from a resume?

To make your Tax Consultant CV stand out, emphasize your specific tax knowledge and achievements. Quantify results such as tax savings achieved or audit issues resolved. Highlight any specialized tax software proficiency, certifications like Certified Tax Coach (CTC), or ongoing tax law education. Tailor your CV to each job, using keywords from the job description. This will demonstrate your suitability and make your CV resonate with hiring managers.